"Portfolios of the Poor" unveils the hidden financial lives of the impoverished, diving into their complex strategies for managing money in a world filled with instability and uncertainty. The authors, through in-depth interviews and case studies, reveal how the poor navigate financial challenges, using unique savings and credit methods that defy conventional wisdom. This eye-opening exploration challenges stereotypes and presents a surprising picture of resilience and resourcefulness. With poignant insights and compelling narratives, it invites readers to rethink the nature of poverty and the economic systems that surround it. Discover how the choices made by those at the bottom of the economic ladder can shed light on broader financial issues facing society today.

By Daryl Collins, Jonathan Morduch, Stuart Rutherford, Orlanda Ruthven

Published: 2009

""The financial lives of the poor are not a mystery; they are a complex tapestry woven from dreams, struggles, and resilient choices.""

In this work, the authors report on the yearlong 'financial diaries' of villagers and slum dwellers in Bangladesh, India, and South Africa. The stories of these families are often surprising and inspiring.

Showing 8 of 29 similar books

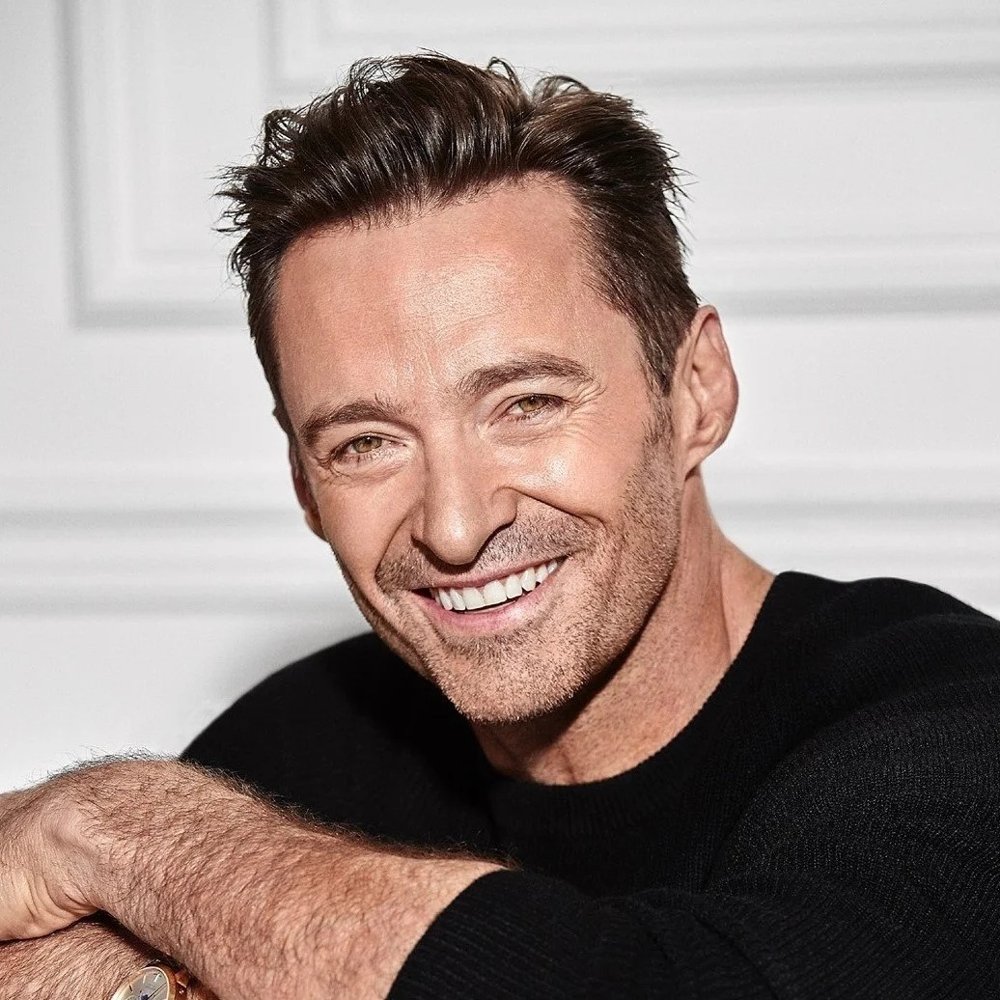

Hugh Jackman, better known for his illustrious acting career, has made significant contributions to literature through his co-authorship of the popular children's book series, "The School of Life." Born in Sydney, Australia, Jackman has seamlessly transitioned from stage and screen to the literary world, captivating young readers with his imaginative storytelling. His work in literature reflects his versatility and dedication to inspiring and educating children. Alongside his wife, Deborra-Lee Furness, Jackman has also been involved in various philanthropic efforts, promoting literacy and education globally. Despite his Hollywood fame, Jackman's contributions to literature highlight his commitment to nurturing young minds.

Brian Tracy is a renowned Canadian-American motivational speaker, self-development author, and business consultant. He has written over 70 books, including bestsellers like "Eat That Frog!" and "The Psychology of Achievement," which have been translated into dozens of languages. Tracy's work primarily focuses on personal success, leadership, time management, and sales strategies. He has also delivered over 5,000 speeches and seminars around the world, inspiring millions to improve their lives and careers. His practical advice and actionable insights have cemented his reputation as a leading authority in personal and professional development.

Mark Zuckerberg is an American technology entrepreneur best known for co-founding Facebook, the world's largest social media platform, which transformed global communication. Born on May 14, 1984, in White Plains, New York, he launched Facebook in 2004 while attending Harvard University. Under his leadership, Facebook expanded rapidly, influencing the social media landscape and digital advertising. Zuckerberg has also authored numerous articles and essays on technology, innovation, and the future of the internet. His work has had a profound impact on how people connect and share information in the digital age.

Ray Dalio is the founder of Bridgewater Associates, one of the largest and most successful hedge funds in the world. He is also the author of the bestselling book Principles, where he outlines his philosophy on life, leadership, and investing. Ray is renowned for his unique approach to transparency, radical truth, and thoughtful disagreement within organizations. His insights into economics and investing have made him one of the most influential figures in the financial world. Dalio continues to be a thought leader in business, economics, and philanthropy.

Alex Lieberman is the co-founder and executive chairman of Morning Brew, a media company that delivers engaging business news. Under his leadership, Morning Brew has grown to reach millions of subscribers, becoming a significant player in modern business journalism. Lieberman is also known for his insightful commentary on entrepreneurship and media trends. His work has significantly influenced the way business news is consumed by younger audiences. Beyond Morning Brew, Lieberman frequently writes and speaks about the intersection of media and technology, further cementing his role as a thought leader in the industry.

Scott Pape, known as The Barefoot Investor, is an Australian financial advisor and author, best known for his best-selling book The Barefoot Investor: The Only Money Guide You’ll Ever Need. Pape’s simple, no-nonsense approach to personal finance has helped millions of Australians get out of debt, build savings, and invest for the future. His advice is based on practical, straightforward strategies that focus on budgeting, long-term investments, and financial independence. Pape’s work as a financial educator has made him one of the most trusted voices in personal finance, and his book has become one of the most successful financial guides in Australia.

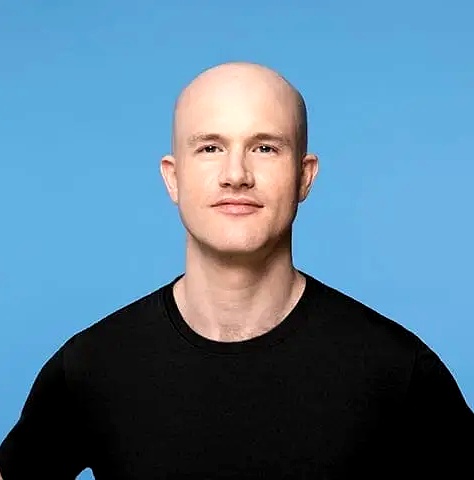

Brian Armstrong is a renowned entrepreneur and author best known for co-founding and leading Coinbase, a major cryptocurrency exchange. His literary contributions include insightful writings on the future of digital currencies and blockchain technology. Armstrong's work has been pivotal in demystifying complex financial systems for a broader audience. Beyond his business acumen, his thought leadership in publications and public speaking engagements has cemented his status as a key voice in the fintech revolution. His dedication to innovation continues to influence the trajectory of global financial systems.

Sheryl Sandberg is the COO of Meta (formerly Facebook) and the author of the bestselling book Lean In, which encourages women to pursue leadership roles and create gender equality in the workplace. She is a prominent advocate for women’s rights, particularly in corporate environments, and has launched initiatives to support women’s empowerment globally. Sheryl’s leadership at Facebook helped the company grow into one of the world’s largest social media platforms. She is also the founder of LeanIn.Org, a nonprofit dedicated to empowering women.

Showing 8 of 9 related collections

“"The financial lives of the poor are not a mystery; they are a complex tapestry woven from dreams, struggles, and resilient choices."”

Portfolios of the Poor

By Daryl Collins, Jonathan Morduch, Stuart Rutherford, Orlanda Ruthven

Discover a world of knowledge through our extensive collection of book summaries.

Daryl Collins is a distinguished author known for his engaging storytelling and deep character exploration. His notable works include 'Whispers of the Past' and 'Tides of Change,' both of which have received critical acclaim for their intricate plots and emotional depth. Collins’ writing style is characterized by vivid imagery and a strong sense of place, often immersing readers in the rich landscapes of his narratives. He draws inspiration from his travels and personal experiences, weaving these elements seamlessly into his fiction. Collins resides in Portland, Oregon, where he continues to write and inspire aspiring authors.

Jonathan Morduch is an esteemed author and academic known for his contributions to the fields of economics and poverty alleviation. A professor at New York University's Wagner Graduate School of Public Service, he has conducted extensive research on microfinance, development economics, and the financial behaviors of low-income households. Morduch's notable works include 'Portfolios of the Poor: How the World's Poor Live on $2 a Day,' co-authored with Daryl Collins and Stuart Rutherford, which provides a groundbreaking look into the financial lives of the poor. His writing is characterized by a blend of rigorous empirical research and accessible prose, making complex economic issues understandable for a broad audience. Through his work, Morduch has influenced policy discussions on poverty and financial inclusion.

Stuart Rutherford is an acclaimed author known for his engaging storytelling and insightful exploration of human emotions. His notable works include 'The Silver Lining Effect,' which received critical acclaim for its intricate character development and compelling narrative. Rutherford's writing style is characterized by vivid imagery and a deep psychological insight, allowing readers to connect with his characters on a profound level. He has also contributed to various literary journals and has spoken at numerous literary events, further establishing his reputation as a significant voice in contemporary literature.

Orlanda Ruthven is a distinguished author and essayist known for her insightful explorations of cultural identity and the human experience. Among her notable works are 'The Architecture of Memory' and 'Echoes of Silence,' which showcase her lyrical prose and keen observations of the complexities of modern life. Ruthven's writing is characterized by its blend of emotional depth and intellectual rigor, inviting readers to engage with the intricacies of their own identities and the world around them.

Key information about the book.

Support local bookstores: BookShop gives a portion of each sale to independent bookshops!

No summary available

In "The Millionaire Next Door," Thomas J. Stanley and William D. Danko reveal surprising truths about the habits and lifestyles of America's wealthy. Rather than flashy spending, these millionaires embody frugality, discipline, and the pursuit of financial independence. Uncover the principles that distinguish the affluent from those who merely appear wealthy, and learn how everyday choices shape true wealth. Through eye-opening statistics and relatable anecdotes, this book dismantles common misconceptions about wealth. Are you ready to discover the secrets of those living quietly among us who have amassed true fortunes?

In "Women & Money," Suze Orman empowers women to take control of their financial destinies with insightful advice and practical strategies. Through personal anecdotes and expert tips, she dismantles the societal myths that often hinder women's financial confidence. Orman explores the emotional connections to money, urging readers to embrace their worth and create a secure future. With a blend of tough love and encouragement, she offers a roadmap to financial independence that resonates deeply. Discover how understanding your relationship with money can transform not just your finances, but your entire life.

In "The Money Class," Suze Orman redefines financial literacy in a world where traditional rules no longer apply. She reveals the secrets to navigating modern economic challenges, providing actionable advice on saving, investing, and building wealth. Orman emphasizes the importance of understanding your personal values and translating them into financial choices. With relatable stories and practical tips, she empowers readers to take control of their financial futures. Are you ready to transform your relationship with money and unlock the life you deserve?

In "The Real Book of Real Estate," author Robert Kiyosaki unearths the hidden gems of wealth-building through property investment. With candid insights drawn from his own experiences, he dismantles common myths and reveals the strategies that can lead to financial freedom. This book isn’t just about numbers; it’s a masterclass in mindset, emphasizing the importance of surrounding yourself with the right team and resources. Kiyosaki’s engaging anecdotes and practical tips will inspire both novices and seasoned investors to reassess their approach to real estate. Prepare to unlock the secrets that could transform your financial future and discover the potential of becoming a savvy property mogul!

In "The Total Money Makeover," financial guru Dave Ramsey unveils a transformative plan to overhaul your personal finances, empowering readers to break free from debt and build lasting wealth. Through practical steps and relatable success stories, he demystifies budgeting and saving, revealing the secrets to financial independence. Ramsey introduces his straightforward "Baby Steps" approach, guiding readers from caution to confidence on their journey to financial freedom. Packed with actionable advice and motivational insights, this book challenges conventional wisdom and inspires a total mindset shift. Are you ready to embark on a journey that could reshape your financial future?

In "More Than Enough," author Elaine Welteroth shares her transformative journey from a young girl with big dreams to a powerful voice in the fashion industry. With candid anecdotes and inspiring insights, she challenges societal norms and embraces her authentic self. As the first African American editor-in-chief of Teen Vogue, Welteroth delves into themes of identity, resilience, and empowerment, inviting readers to reflect on their own narratives. The book is a celebration of diversity and self-acceptance, urging us all to break barriers and claim our space in the world. Get ready to be inspired and motivated to redefine what “enough” truly means!

In 'I Will Teach You to Be Rich, Second Edition,' Ramit Sethi provides a no-nonsense guide to mastering personal finance with a blend of humor and practicality. He challenges conventional money advice and introduces readers to a unique banking system for maximizing their savings. Through straightforward strategies, Sethi reveals how to automate finances and invest wisely for the long term. Each chapter brims with actionable tips that encourage readers to take control of their financial futures. With insights that delve deep into psychology and behavior, this book is a game-changer for anyone seeking to build real wealth.