Investing Books

Investing books offer crucial knowledge for building wealth and securing financial futures in today's dynamic market environment. Learn fundamental principles of asset allocation, risk management, and portfolio diversification. Explore various investment vehicles, from stocks and bonds to real estate and cryptocurrencies. Gain insights into market analysis, value investing, and long-term wealth accumulation strategies. Discover how to navigate economic cycles, understand financial statements, and make informed investment decisions. Whether you're a novice investor or seasoned professional, these books provide valuable tools and techniques for maximizing returns and achieving financial goals.

Start Listening to Book Summary

Book Summaries of Top Investing Books →

The Intelligent Investor Book Summary

In "The Intelligent Investor," Benjamin Graham unveils timeless strategies for navigating the volatile world of investing with wisdom and discipline. He introduces the concept of value investing, teaching readers to distinguish between price and intrinsic value, all while emphasizing the importance of a defensive investment strategy. Graham’s insightful principles empower investors to cultivate emotional resilience, protecting them from the relentless whims of the market. With real-world anecdotes and practical advice, this classic remains a cornerstone for anyone seeking financial success and peace of mind. Dive in to discover how patience, rationality, and a solid plan can transform your investment journey!

The Real Book of Real Estate Book Summary

In "The Real Book of Real Estate," author Robert Kiyosaki unearths the hidden gems of wealth-building through property investment. With candid insights drawn from his own experiences, he dismantles common myths and reveals the strategies that can lead to financial freedom. This book isn’t just about numbers; it’s a masterclass in mindset, emphasizing the importance of surrounding yourself with the right team and resources. Kiyosaki’s engaging anecdotes and practical tips will inspire both novices and seasoned investors to reassess their approach to real estate. Prepare to unlock the secrets that could transform your financial future and discover the potential of becoming a savvy property mogul!

Security Analysis: The Classic 1934 Edition Book Summary

Security Analysis, authored by Benjamin Graham and David Dodd, unveils the art of valuing investments through a detailed lens of fundamental analysis. This classic masterpiece promotes the philosophy of value investing, encouraging readers to dive deep into financial statements rather than relying on market trends. With timeless principles and practical frameworks, it teaches how to uncover hidden gems in the stock market. As markets fluctuate, the authors remind us that understanding intrinsic value can lead to exceptional financial decisions. Are you ready to transform your investment strategies and unlock the secrets of successful investing?

Common Stocks and Uncommon Profits and Other Writings Book Summary

In "Common Stocks and Uncommon Profits," legendary investor Philip A. Fisher shares his groundbreaking approach to evaluating stocks, emphasizing the importance of understanding a company's long-term potential rather than just its current prices. Fisher introduces the "15 Points to Look for in a Common Stock," a comprehensive checklist that reveals the qualities of truly exceptional companies. With insightful anecdotes and practical wisdom, he challenges traditional investment strategies and highlights the significance of a strong management team. As readers delve into his meticulous analysis, they discover how to identify growth opportunities that others might overlook. This classic investment guide is not just a manual for profits; it's an invitation to think differently about wealth creation.

A Random Walk Down Wall Street: The Time-Tested Strategy for Successful Investing (Ninth Edition) Book Summary

In "A Random Walk Down Wall Street," Burton Malkiel challenges the myth of market predictability and unveils the chaos underlying financial markets. Through engaging anecdotes and sharp insights, he demystifies complex investment strategies while advocating for the simplicity of index funds. Readers are taken on a journey through the history of financial theory and practical investing advice, revealing how randomness shapes market movements. Malkiel's compelling arguments will make you question conventional wisdom and reconsider your approach to investing. Are you ready to explore the unpredictable world of finance and learn how to navigate it wisely?

The Warren Buffett Portfolio Book Summary

Dive into the investment genius of Warren Buffett through Robert G. Hagstrom's enlightening exploration, 'The Warren Buffett Portfolio.' This book unveils Buffett's unique strategies and philosophies, offering readers a glimpse into the mind of one of the wealthiest investors of all time. From the importance of patience and discipline to the power of value investing, Hagstrom distills complex concepts into actionable insights. You’ll discover not just what Buffett invests in, but how he thinks about risk, opportunity, and the markets. Whether you're a novice or an experienced investor, this book challenges you to rethink your approach to wealth creation.

Poor Charlie's Almanack Book Summary

Dive into 'Poor Charlie's Almanack,' where Charles T. Munger, the brilliant mind behind Berkshire Hathaway, shares his wealth of knowledge and unconventional wisdom. This compelling guide offers a treasure trove of insights on decision-making, investing, and life philosophy that challenges conventional thinking. Through a blend of humor and candor, Munger's reflections reveal the power of multidisciplinary thinking and mental models. With engaging anecdotes and practical advice, readers are encouraged to expand their intellectual horizons and apply these lessons in their own lives. Unlock the secrets to success and learn how to navigate the complexities of life with Munger's unique perspective!

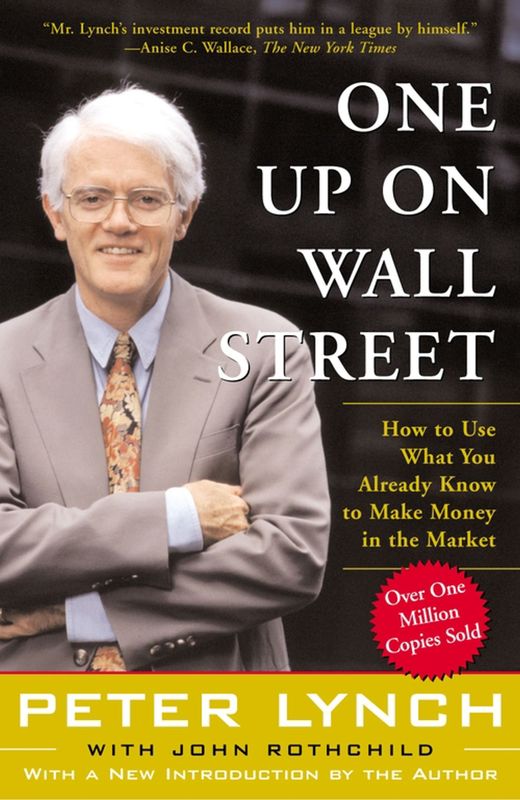

One Up on Wall Street Book Summary

In 'One Up on Wall Street', legendary investor Peter S. Lynch shares his investment philosophy that empowers everyday individuals to confidently navigate the stock market. With insightful anecdotes and a no-nonsense approach, Lynch reveals how to identify promising companies before they become household names. He emphasizes the importance of doing your homework and investing in what you know, challenging traditional investment strategies. Lynch's compelling narrative demystifies stock picking, making it accessible to both novice and seasoned investors. Will you discover the secrets to outperforming Wall Street?

Showing 8 of 25 books in Investing

View all booksExplore Our Catalogue

Discover a world of knowledge through our extensive collection of book summaries.

Genres

Genres

Genres

Featured Collections

- Top Book Club Picks

- One-Stop Nutrition

- Summer Reads 2024

- Best Beach Reads 2024

- Work-Life Balance Guide

- Time Management

- Healthy Foods

- Entrepreneur Toolkit

- Mind & Body Wellness

- Future Tech Insights

- Leadership Essentials

- Financial Freedom

- Sci-Fi Masterpieces

- Parenting 101

- Books That Became Blockbusters

- Guide to a Healthy Pregnancy