Security Analysis, authored by Benjamin Graham and David Dodd, unveils the art of valuing investments through a detailed lens of fundamental analysis. This classic masterpiece promotes the philosophy of value investing, encouraging readers to dive deep into financial statements rather than relying on market trends. With timeless principles and practical frameworks, it teaches how to uncover hidden gems in the stock market. As markets fluctuate, the authors remind us that understanding intrinsic value can lead to exceptional financial decisions. Are you ready to transform your investment strategies and unlock the secrets of successful investing?

By Benjamin Graham, David Le Fevre Dodd

Published: 1934

"Investment is most intelligent when it is most businesslike."

Explains financial analysis techniques, shows how to interpret financial statements, and discusses the analysis of fixed-income securities and the valuation of stocks.

Showing 8 of 22 similar books

Bill Ackman is an American hedge fund manager and founder of Pershing Square Capital Management, known for his activist investing style. Ackman has been involved in high-profile investment battles, including his campaigns against companies like Herbalife and his successful turnaround of companies like Canadian Pacific Railway. He is known for taking bold, contrarian positions and for his ability to influence corporate governance through shareholder activism. Ackman’s investing philosophy focuses on long-term value creation, and he has become one of the most recognized figures in the finance world.

Alex Lieberman is the co-founder and executive chairman of Morning Brew, a media company that delivers engaging business news. Under his leadership, Morning Brew has grown to reach millions of subscribers, becoming a significant player in modern business journalism. Lieberman is also known for his insightful commentary on entrepreneurship and media trends. His work has significantly influenced the way business news is consumed by younger audiences. Beyond Morning Brew, Lieberman frequently writes and speaks about the intersection of media and technology, further cementing his role as a thought leader in the industry.

David Heinemeier Hansson, also known as DHH, is a Danish programmer, entrepreneur, and author, best known as the creator of Ruby on Rails, a popular web application framework. Heinemeier Hansson is also a partner at Basecamp, a project management and collaboration software company he co-founded. His contributions to software development have earned him widespread recognition, with Ruby on Rails being used by thousands of developers and companies worldwide. Heinemeier Hansson is also a vocal advocate for remote work, simplicity in business, and sustainable work practices, ideas he explores in his bestselling books Rework and It Doesn’t Have to Be Crazy at Work. In addition to his work in tech, he is an accomplished race car driver, having competed in the 24 Hours of Le Mans. Heinemeier Hansson’s approach to work-life balance and entrepreneurship has made him a thought leader in the tech community, where he continues to challenge traditional business practices and advocate for more human-centered approaches to work

Charlie Munger is an American investor, businessman, and philanthropist, best known as the vice chairman of Berkshire Hathaway, where he partners with Warren Buffett. Renowned for his insights on investment strategies and mental models, Munger has significantly influenced the world of finance. His notable literary contributions include "Poor Charlie's Almanack," a compilation of his speeches and writings that distill his wisdom on decision-making and business principles. Munger's work emphasizes the importance of multidisciplinary thinking and continuous learning. Beyond his financial acumen, he is celebrated for his charitable efforts, particularly in education and healthcare.

Howard Marks was a renowned Welsh author and drug smuggler, best known for his bestselling autobiography, "Mr Nice," published in 1996. The book chronicles his complex life, from Oxford University graduate to one of the world's most infamous cannabis traffickers. Marks' candid storytelling and unique perspective earned him a cult following and critical acclaim, transforming him into a counterculture icon. He further contributed to literature with several other works, including "Señor Nice" and "Sympathy for the Devil." Marks' legacy continues to influence discussions on drug policy and the criminal justice system.

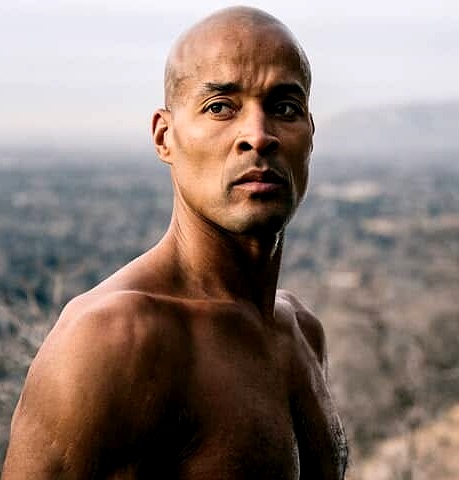

David Goggins is a retired Navy SEAL and former U.S. Air Force Tactical Air Control Party member who has gained widespread recognition for his extraordinary achievements in endurance sports and personal development. As an ultramarathon runner, triathlete, and world record holder for completing 4,030 pull-ups in 17 hours, Goggins exemplifies unparalleled mental and physical resilience. His memoir, "Can't Hurt Me: Master Your Mind and Defy the Odds," has become a bestseller, inspiring millions with its powerful messages of overcoming adversity and pushing beyond perceived limits. Goggins is also a sought-after motivational speaker, known for his no-excuses approach to self-improvement. His story continues to motivate individuals around the globe to embrace challenges and strive for excellence.

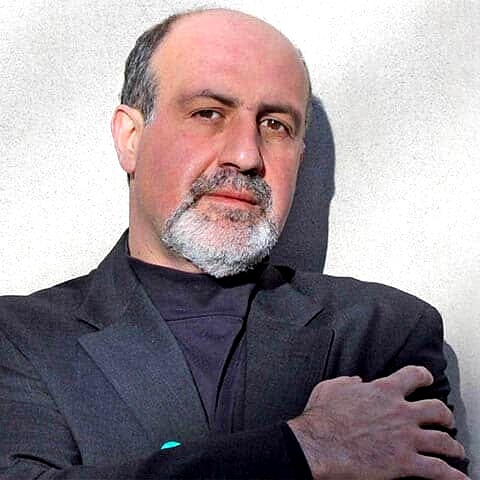

Nassim Nicholas Taleb is a Lebanese-American author, scholar, and risk analyst, best known for his work on uncertainty, probability, and risk. His books, including The Black Swan and Antifragile, explore how rare and unpredictable events shape the world and how individuals and systems can become more resilient to shocks. Taleb’s insights on risk management have influenced fields ranging from finance to medicine, and he is known for his outspoken criticism of conventional wisdom. His ideas about randomness, decision-making, and the limitations of human knowledge have made him a leading thinker in modern economics and philosophy.

Jamie Dimon is an American business executive, best known as the Chairman and CEO of JPMorgan Chase, one of the largest and most influential financial institutions in the world. Dimon has led JPMorgan through multiple economic crises, including the 2008 financial crash, and has consistently been recognized for his leadership in the banking industry. Under his tenure, JPMorgan has grown into a global financial powerhouse, focusing on innovation and sustainability. Dimon is also an advocate for corporate responsibility and frequently speaks on economic and regulatory issues. His leadership style and strategic insights have earned him widespread respect in the business world.

Showing 8 of 14 related collections

“Investment is most intelligent when it is most businesslike.”

Security Analysis

By Benjamin Graham, David Le Fevre Dodd

Discover a world of knowledge through our extensive collection of book summaries.

Benjamin Graham (1894-1976) was an influential American economist and investor, widely regarded as the father of value investing. His seminal works, including "The Intelligent Investor" and "Security Analysis," laid the foundation for modern investment strategies by emphasizing the importance of fundamental analysis and a disciplined approach to investing. Graham advocated for a margin of safety in financial decisions, encouraging investors to prioritize long-term value over market speculation. As a professor at Columbia Business School, he mentored several prominent investors, including Warren Buffett, who cites Graham's philosophies as a major influence on his own investment approach. Graham's legacy continues to shape investment practices and is celebrated for his pioneering contributions to the field of finance.

David Le Fevre Dodd is an acclaimed author known for his evocative prose and deep exploration of human experiences. His notable works include The Song of Lost Horizons and Echoes of the Forgotten, both celebrated for their lyrical narrative and rich character development. Dodd's writing style is characterized by a seamless blend of introspective dialogue and vivid imagery, allowing readers to immerse themselves fully in the worlds he creates. With a background in literary studies and creative writing, Dodd continues to captivate audiences with his unique voice and insightful themes, making significant contributions to contemporary literature.

Key information about the book.

Support local bookstores: BookShop gives a portion of each sale to independent bookshops!

In "The Intelligent Investor," Benjamin Graham unveils timeless strategies for navigating the volatile world of investing with wisdom and discipline. He introduces the concept of value investing, teaching readers to distinguish between price and intrinsic value, all while emphasizing the importance of a defensive investment strategy. Graham’s insightful principles empower investors to cultivate emotional resilience, protecting them from the relentless whims of the market. With real-world anecdotes and practical advice, this classic remains a cornerstone for anyone seeking financial success and peace of mind. Dive in to discover how patience, rationality, and a solid plan can transform your investment journey!

In "Smart Women Finish Rich," financial expert David Bach unveils transformative strategies tailored specifically for women to take control of their financial futures. With compelling stories and practical insights, he challenges traditional perceptions of wealth and showcases the power of financial literacy. The book offers a step-by-step roadmap for saving and investing, emphasizing the importance of both planning and emotional intelligence in money matters. Through Bach's relatable approach, readers will discover how to build lasting wealth while cultivating a fulfilling life. Are you ready to unlock the secrets to financial freedom and transform your relationship with money?

In "The Latte Factor," personal finance expert David Bach unveils a transformative story that intertwines the journey of a young woman discovering the power of financial freedom. Through the lens of a seemingly simple daily ritual—her coffee habit—she learns profound lessons about saving and investing. With relatable characters and an engaging narrative, Bach challenges readers to rethink their spending habits and recognize the true cost of indulgences. Could a small shift in perspective lead to monumental changes in your financial future? Dive into this inspiring tale and unlock the secrets to achieving your dreams, one latte at a time!

In "The Total Money Makeover," financial guru Dave Ramsey unveils a transformative plan to overhaul your personal finances, empowering readers to break free from debt and build lasting wealth. Through practical steps and relatable success stories, he demystifies budgeting and saving, revealing the secrets to financial independence. Ramsey introduces his straightforward "Baby Steps" approach, guiding readers from caution to confidence on their journey to financial freedom. Packed with actionable advice and motivational insights, this book challenges conventional wisdom and inspires a total mindset shift. Are you ready to embark on a journey that could reshape your financial future?

In "Everyday Millionaires," authors Chris Hogan unravel the surprising truths behind the wealth of ordinary people who have achieved extraordinary financial success. Through compelling stories and real-life data, they challenge the myths of wealth, revealing that most millionaires live modestly and prioritize saving and investing over luxury. Hogan shares actionable insights on mindsets, financial habits, and the importance of perseverance, encouraging readers to rethink their own paths to wealth. The book empowers individuals to believe that anyone can attain financial independence with dedication and sensible strategies. Are you ready to unlock the secrets of everyday millionaires and transform your financial future?

In "The Psychology of Money," Morgan Housel unravels the complex relationship between our emotions and financial decisions. Through captivating anecdotes and profound insights, he reveals that wealth isn't just about numbers, but about behavior and mindset. The book challenges conventional wisdom, urging readers to understand the subtle psychological forces that influence our spending and saving habits. Housel's reflections highlight the power of patience, humility, and a long-term perspective in building true financial success. Prepare to rethink everything you thought you knew about money and its role in your life!

**The Little Book of Behavioral Investing** uncovers the psychological traps that often lead investors astray. With a blend of insightful anecdotes and cutting-edge research, it reveals how emotions like fear and greed shape our decisions in the financial world. Readers will discover practical strategies to counteract these biases and improve their investment outcomes. By understanding the behavioral factors at play, you can transform your investment approach. Are you ready to challenge your thinking and elevate your financial game?

In "Financial Freedom," Grant Sabatier unveils the transformative journey from scarcity to abundance, sharing his compelling story of achieving a million-dollar net worth in just five years. The book combines actionable strategies with powerful insights, challenging conventional beliefs about work, money, and happiness. Sabatier emphasizes the importance of redefining your relationship with wealth and creating multiple income streams to escape the rat race. With practical tips on budgeting, investing, and mindset shifts, readers are equipped to take bold steps toward their financial goals. Dive into this guide and discover the blueprint that could lead you to a life of true financial independence!