Bill Ackman's Book Recommendations

Bill Ackman is an American hedge fund manager and founder of Pershing Square Capital Management, known for his activist investing style. Ackman has been involved in high-profile investment battles, including his campaigns against companies like Herbalife and his successful turnaround of companies like Canadian Pacific Railway. He is known for taking bold, contrarian positions and for his ability to influence corporate governance through shareholder activism. Ackman’s investing philosophy focuses on long-term value creation, and he has become one of the most recognized figures in the finance world.

Start Listening to Book Summary

Books in the Collection

Showing 8 of 11 books in this collection

Book Summaries

Security Analysis: Sixth Edition, Foreword by Warren Buffett Book Summary

In 'Security Analysis,' Benjamin Graham and David Dodd unveil the timeless principles of value investing that have guided astute investors for decades. This sixth edition, with a foreword by Warren Buffett, emphasizes the importance of thorough financial analysis and prudent decision-making. Readers will discover powerful techniques to evaluate stocks and bonds through a deep understanding of intrinsic value and market psychology. Graham and Dodd's insights challenge conventional wisdom, encouraging a disciplined approach to investing. Whether you're a novice or a seasoned investor, this seminal work promises to revolutionize your financial strategy.

Margin of Safety Book Summary

In 'Margin of Safety,' esteemed investor Seth A. Klarman presents a compelling treatise on value investing, emphasizing the importance of risk management and investment discipline. He challenges conventional wisdom and offers a treasure trove of insights on how to navigate the stock market's unpredictable nature. With intriguing case studies and a candid perspective, Klarman illustrates the pitfalls of speculative investing. This book is not just a guide for investors; it's a blueprint for achieving genuine financial security. Unlock the secrets of successful investing and discover why genius often lies in the margins.

The Warren Buffett Way Book Summary

In 'The Warren Buffett Way', Robert G. Hagstrom unveils the investment strategies and philosophies that have made Warren Buffett one of the most successful investors in history. Through insightful anecdotes and clear analysis, readers discover the principles that guide Buffett's decisions in the stock market. The book delves into the importance of patience, value investing, and understanding businesses beyond their numbers. With a blend of practical advice and timeless wisdom, it challenges conventional investing myths. Prepare to rethink your approach to finance and embrace the mindset of a true investment maestro.

Confidence Game Book Summary

In 'Confidence Game', Christine S. Richard explores the intricate world of con artists and the psychology behind their manipulative tactics. Through gripping narratives and real-life examples, she unveils how trust can be both a weapon and a tool for deception. The book dives deep into the profiles of scammers and the unsuspecting victims who fall prey to their schemes. As Richard distinguishes between genuine confidence and deceitful charm, readers are left questioning their own perceptions of trust. This thrilling exploration of manipulation will make you rethink the nature of confidence itself.

Quality of Earnings Book Summary

In 'Quality of Earnings', Thornton L. O'glove and Robert Sobel unveil the intricate relationship between financial statements and the true performance of a company. This compelling analysis reveals the often-misleading nature of reported earnings and empowers investors to look beyond the surface. Through captivating case studies, the authors illustrate how to identify red flags and gain insight into a company's actual financial health. As you navigate the complexities of earnings quality, you'll discover invaluable tools for making informed investment decisions. Dive into this essential guide and transform your approach to evaluating corporate performance!

You Can Be a Stock Market Genius Book Summary

In 'You Can Be a Stock Market Genius', Joel Greenblatt unveils the secrets of successful investing with a fresh perspective that demystifies the stock market. He emphasizes the importance of special situations such as spin-offs, mergers, and restructurings that can lead to extraordinary investment opportunities. Greenblatt's witty and engaging style simplifies complex concepts, making them accessible to everyday investors. With practical strategies and real-world examples, he empowers readers to become savvy market participants. Dive into this compelling read and discover how you, too, can master the art of investing and unlock your financial potential!

One Up on Wall Street Book Summary

In 'One Up on Wall Street', legendary investor Peter S. Lynch shares his investment philosophy that empowers everyday individuals to confidently navigate the stock market. With insightful anecdotes and a no-nonsense approach, Lynch reveals how to identify promising companies before they become household names. He emphasizes the importance of doing your homework and investing in what you know, challenging traditional investment strategies. Lynch's compelling narrative demystifies stock picking, making it accessible to both novice and seasoned investors. Will you discover the secrets to outperforming Wall Street?

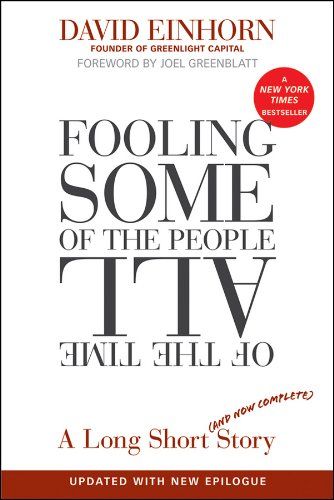

Fooling Some of the People All of the Time, A Long Short (and Now Complete) Story, Updated with New Epilogue Book Summary

In 'Fooling Some of the People All of the Time,' David Einhorn unveils the intricate web of lies and deception surrounding the financial world, particularly his infamous battle against a prominent company. This captivating narrative is not just a tale of investment loss but a profound examination of ethics, truth, and accountability. With detailed accounts and sharp analysis, Einhorn reveals the shocking lengths to which some will go to maintain their façade. Updated with a new epilogue, the story reflects on the aftermath of his struggles and the ongoing implications in today's financial landscape. Prepare to question everything you thought you knew about trust and transparency in the markets!