In 'Security Analysis,' Benjamin Graham and David Dodd unveil the timeless principles of value investing that have guided astute investors for decades. This sixth edition, with a foreword by Warren Buffett, emphasizes the importance of thorough financial analysis and prudent decision-making. Readers will discover powerful techniques to evaluate stocks and bonds through a deep understanding of intrinsic value and market psychology. Graham and Dodd's insights challenge conventional wisdom, encouraging a disciplined approach to investing. Whether you're a novice or a seasoned investor, this seminal work promises to revolutionize your financial strategy.

By Benjamin Graham, David Dodd

Published: 2008

"'Investing isn't about beating others at their game. It's about controlling yourself at your own game.'"

"A road map for investing that I have now been following for 57 years." --From the Foreword by Warren E. Buffett First published in 1934, Security Analysis is one of the most influential financial books ever written. Selling more than one million copies through five editions, it has provided generations of investors with the timeless value investing philosophy and techniques of Benjamin Graham and David L. Dodd. As relevant today as when they first appeared nearly 75 years ago, the teachings of Benjamin Graham, “the father of value investing,” have withstood the test of time across a wide diversity of market conditions, countries, and asset classes. This new sixth edition, based on the classic 1940 version, is enhanced with 200 additional pages of commentary from some of today’s leading Wall Street money managers. These masters of value investing explain why the principles and techniques of Graham and Dodd are still highly relevant even in today’s vastly different markets. The contributor list includes: Seth A. Klarman, president of The Baupost Group, L.L.C. and author of Margin of Safety James Grant, founder of Grant's Interest Rate Observer, general partner of Nippon Partners Jeffrey M. Laderman, twenty-five year veteran of BusinessWeek Roger Lowenstein, author of Buffett: The Making of an American Capitalist and When America Aged and Outside Director, Sequoia Fund Howard S. Marks, CFA, Chairman and Co-Founder, Oaktree Capital Management L.P. J. Ezra Merkin, Managing Partner, Gabriel Capital Group . Bruce Berkowitz, Founder, Fairholme Capital Management. Glenn H. Greenberg, Co-Founder and Managing Director, Chieftain Capital Management Bruce Greenwald, Robert Heilbrunn Professor of Finance and Asset Management, Columbia Business School David Abrams, Managing Member, Abrams Capital Featuring a foreword by Warren E. Buffett (in which he reveals that he has read the 1940 masterwork “at least four times”), this new edition of Security Analysis will reacquaint you with the foundations of value investing—more relevant than ever in the tumultuous 21st century markets.

Showing 8 of 30 similar books

Bill Ackman is an American hedge fund manager and founder of Pershing Square Capital Management, known for his activist investing style. Ackman has been involved in high-profile investment battles, including his campaigns against companies like Herbalife and his successful turnaround of companies like Canadian Pacific Railway. He is known for taking bold, contrarian positions and for his ability to influence corporate governance through shareholder activism. Ackman’s investing philosophy focuses on long-term value creation, and he has become one of the most recognized figures in the finance world.

Naval Ravikant is an entrepreneur, angel investor, and philosopher, best known as the co-founder of AngelList, a platform that connects startups with investors. Ravikant is a prolific thinker and writer on topics such as startups, investing, and personal well-being, sharing his wisdom through essays, podcasts, and social media. He has invested in over 100 companies, including Uber, Twitter, and Yammer, making him one of Silicon Valley’s most successful angel investors. Ravikant is also known for his philosophical musings on wealth, happiness, and the meaning of life, which have garnered him a large and dedicated following.

Charlie Munger is an American investor, businessman, and philanthropist, best known as the vice chairman of Berkshire Hathaway, where he partners with Warren Buffett. Renowned for his insights on investment strategies and mental models, Munger has significantly influenced the world of finance. His notable literary contributions include "Poor Charlie's Almanack," a compilation of his speeches and writings that distill his wisdom on decision-making and business principles. Munger's work emphasizes the importance of multidisciplinary thinking and continuous learning. Beyond his financial acumen, he is celebrated for his charitable efforts, particularly in education and healthcare.

Drew Houston is an accomplished American entrepreneur best known for co-founding Dropbox, a widely-used cloud storage service, in 2007. As the CEO, he has led the company to serve millions of users worldwide and become a key player in the tech industry. Although not primarily known for literature, Houston has shared his entrepreneurial insights and experiences through various interviews and public speaking engagements, offering valuable lessons to aspiring business leaders. His work has significantly influenced the way people and organizations manage and share digital content. Houston's innovative vision continues to shape the future of cloud computing and digital collaboration.

Niki Scevak is a distinguished entrepreneur and venture capitalist, widely recognized for his contributions to the startup ecosystem rather than traditional literature. As a co-founder and partner at Blackbird Ventures, he has played a pivotal role in funding and mentoring successful Australian tech startups. Scevak also co-founded Startmate, an influential accelerator program that has shaped numerous early-stage companies. His work has significantly impacted the Australian tech landscape, fostering innovation and entrepreneurial growth. Though not an author of traditional books, his insights and thought leadership are frequently shared through industry publications and speaking engagements.

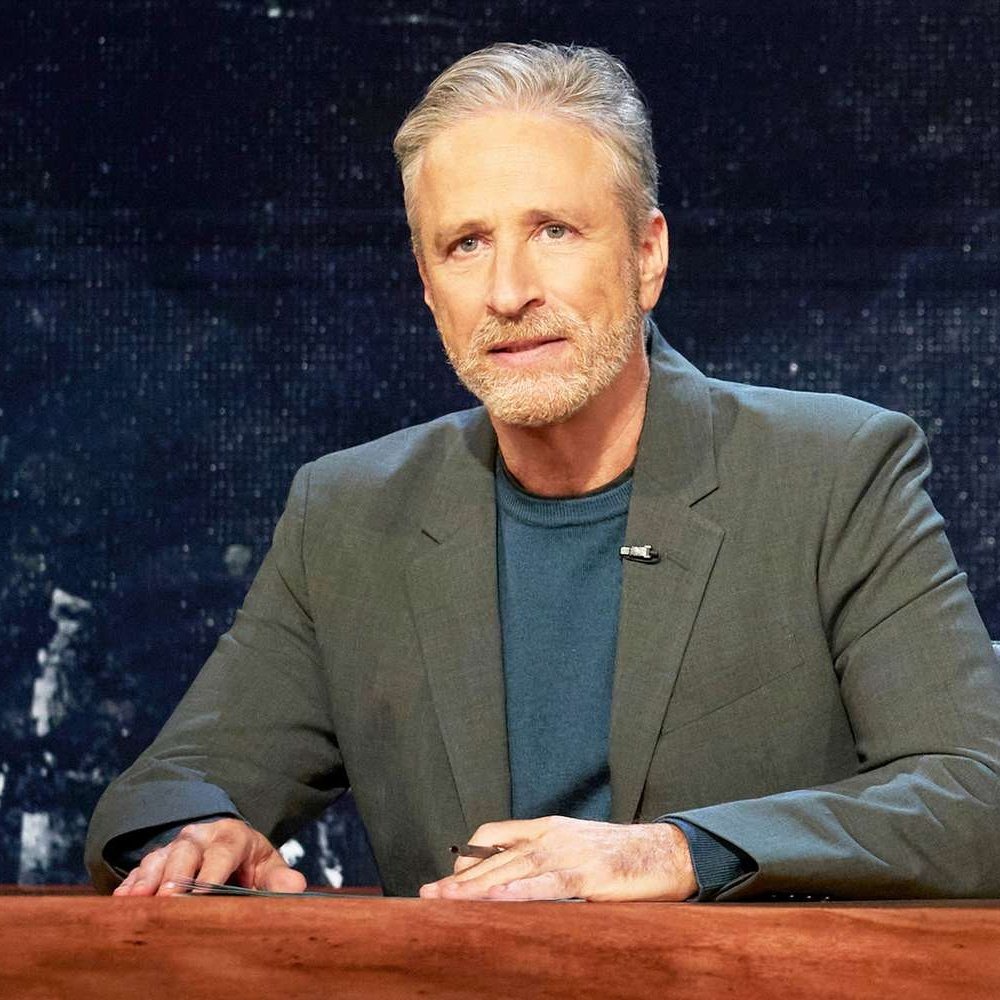

Jon Stewart is an American comedian, writer, and former host of The Daily Show, where he gained fame for his satirical take on news and politics. Stewart transformed The Daily Show into a critical voice in American media, blending humor with hard-hitting commentary on political and social issues. After stepping down from the show, Stewart has continued to advocate for causes like 9/11 first responders and veterans' rights. He is also a filmmaker, directing the political satire film Irresistible. Stewart remains a significant figure in American culture, known for his wit, activism, and influence on political discourse.

Kevin Rose is a notable entrepreneur and technology investor, best known for founding Digg, a pioneering social news website that significantly influenced online content sharing. Although not primarily recognized for literary contributions, Rose has impacted digital media and online culture, which are recurring themes in contemporary literature on technology. His insights and experiences have been featured in various tech journals and books, enriching discussions on innovation and digital entrepreneurship. Rose also co-hosted the popular podcast "The Random Show" with Tim Ferriss, where he shares his thoughts on technology, health, and productivity. Through his ventures and public speaking, Rose continues to inspire narratives around the digital revolution and startup culture.

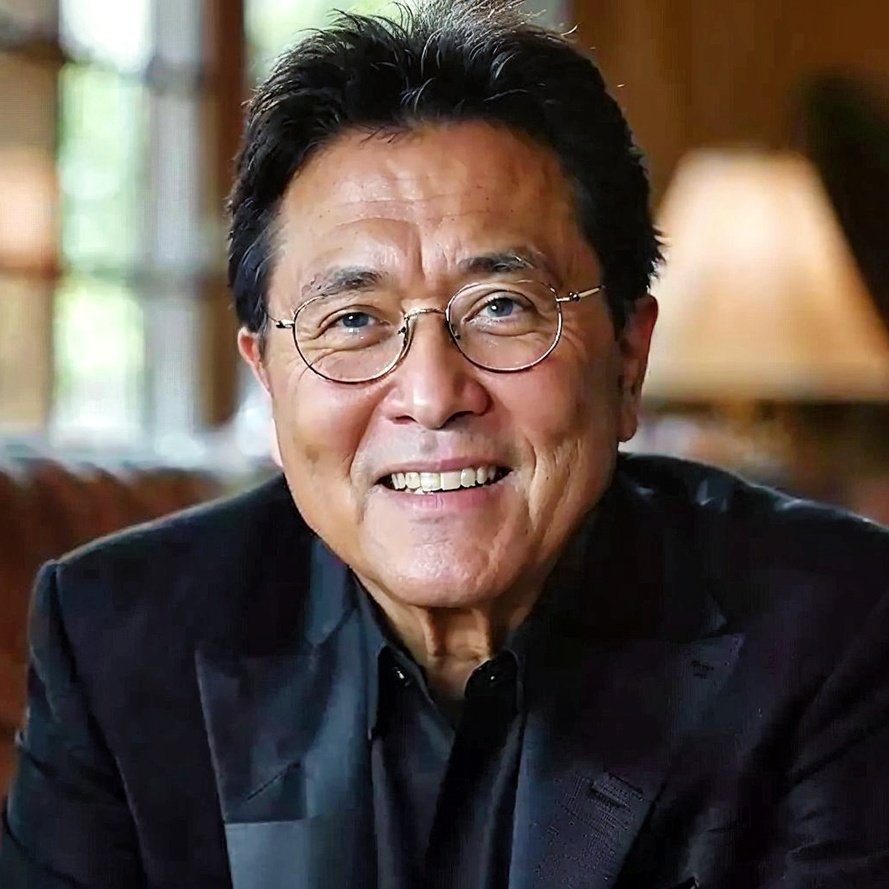

Robert Kiyosaki is the author of the bestselling personal finance book Rich Dad Poor Dad, which challenges conventional wisdom on wealth building and financial literacy. He is a self-made entrepreneur and investor who emphasizes the importance of financial education and investing in assets that generate passive income. His Rich Dad brand has expanded to include books, seminars, and a board game that teaches financial principles. Kiyosaki advocates for self-reliance and encourages individuals to break free from the traditional “employee mindset.” He continues to teach people how to achieve financial independence.

Showing 8 of 18 related collections

“'Investing isn't about beating others at their game. It's about controlling yourself at your own game.'”

Security Analysis

By Benjamin Graham, David Dodd

Discover a world of knowledge through our extensive collection of book summaries.

Benjamin Graham (1894-1976) was an influential American economist and investor, widely regarded as the father of value investing. His seminal works, including "The Intelligent Investor" and "Security Analysis," laid the foundation for modern investment strategies by emphasizing the importance of fundamental analysis and a disciplined approach to investing. Graham advocated for a margin of safety in financial decisions, encouraging investors to prioritize long-term value over market speculation. As a professor at Columbia Business School, he mentored several prominent investors, including Warren Buffett, who cites Graham's philosophies as a major influence on his own investment approach. Graham's legacy continues to shape investment practices and is celebrated for his pioneering contributions to the field of finance.

David Dodd is an acclaimed author known for his incisive storytelling and rich character development. Among his notable works are 'The Fading Light', a haunting exploration of memory and loss, and 'Through the Shadows', a gripping thriller that delves into the human psyche. Dodd's writing is characterized by its lyrical prose and profound emotional depth, often blending elements of suspense with philosophical undertones. He has received several awards for his contributions to contemporary literature and continues to be a prominent voice in the literary community.

Key information about the book.

Support local bookstores: BookShop gives a portion of each sale to independent bookshops!

In "The Intelligent Investor," Benjamin Graham unveils timeless strategies for navigating the volatile world of investing with wisdom and discipline. He introduces the concept of value investing, teaching readers to distinguish between price and intrinsic value, all while emphasizing the importance of a defensive investment strategy. Graham’s insightful principles empower investors to cultivate emotional resilience, protecting them from the relentless whims of the market. With real-world anecdotes and practical advice, this classic remains a cornerstone for anyone seeking financial success and peace of mind. Dive in to discover how patience, rationality, and a solid plan can transform your investment journey!

In "Money: Master the Game," Tony Robbins unlocks the secrets to financial freedom through insights from legendary investors and his own transformative experiences. He presents a comprehensive blueprint that demystifies the world of finance, empowering readers to take control of their financial destinies. Packed with actionable strategies, Robbins reveals the psychological barriers that hold us back from wealth and how to overcome them. The book challenges conventional wisdom, urging readers to think differently about money and investing. Get ready to embark on an enlightening journey that could reshape your financial future forever!

The Money Book for the Young, Fabulous & Broke is your ultimate financial guide, tailored for those navigating the complexities of modern money management. With vibrant insights and relatable anecdotes, author Suze Orman empowers readers to take control of their finances while embracing their youthful exuberance. Discover essential tools for budgeting, saving, and investing, all designed to transform your financial future from daunting to dazzling. Orman’s candid advice challenges you to rethink your relationship with wealth and offers a blueprint for living fabulously, even on a budget. Are you ready to unlock the secrets to financial freedom and become fabulously secure?

In "The Money Class," Suze Orman redefines financial literacy in a world where traditional rules no longer apply. She reveals the secrets to navigating modern economic challenges, providing actionable advice on saving, investing, and building wealth. Orman emphasizes the importance of understanding your personal values and translating them into financial choices. With relatable stories and practical tips, she empowers readers to take control of their financial futures. Are you ready to transform your relationship with money and unlock the life you deserve?

**The Little Book of Behavioral Investing** uncovers the psychological traps that often lead investors astray. With a blend of insightful anecdotes and cutting-edge research, it reveals how emotions like fear and greed shape our decisions in the financial world. Readers will discover practical strategies to counteract these biases and improve their investment outcomes. By understanding the behavioral factors at play, you can transform your investment approach. Are you ready to challenge your thinking and elevate your financial game?

In "Financial Freedom," Grant Sabatier unveils the transformative journey from scarcity to abundance, sharing his compelling story of achieving a million-dollar net worth in just five years. The book combines actionable strategies with powerful insights, challenging conventional beliefs about work, money, and happiness. Sabatier emphasizes the importance of redefining your relationship with wealth and creating multiple income streams to escape the rat race. With practical tips on budgeting, investing, and mindset shifts, readers are equipped to take bold steps toward their financial goals. Dive into this guide and discover the blueprint that could lead you to a life of true financial independence!

Liar's Poker takes you deep into the high-stakes world of Wall Street during the 1980s, where the line between truth and deception blurs in the cutthroat arena of finance. Author Michael Lewis pulls back the curtain on the chaotic life of bond traders, showcasing a ruthless culture driven by greed and bravado. Through vivid anecdotes and sharp insights, readers are thrust into the thrilling, sometimes absurd realm of investment banking. As Lewis navigates the intricacies of "big swinging d***s," he unveils the strategies and psychological games that define success in this high-pressure environment. Will you emerge with a new understanding of the financial world and its enigmatic players?

In "Black Edge," investigative journalist Sheelah Kolhatkar delves into the high-stakes world of hedge funds and the enigmatic figure of Steven A. Cohen. As she unravels the saga of insider trading, greed, and Wall Street's murky ethics, the book pulls readers into a gripping tale of ambition that spans decades. With intellectual prowess and audacious risk-taking, Cohen's rise to power raises questions about the moral compass of finance. Kolhatkar's penetrating analysis unveils the dark side of wealth and the relentless pursuit of success, leaving readers questioning the true cost of ambition. Will you dare to uncover the secrets of a financial titan and the shadowy underworld they inhabit?