In "Financial Freedom," Grant Sabatier unveils the transformative journey from scarcity to abundance, sharing his compelling story of achieving a million-dollar net worth in just five years. The book combines actionable strategies with powerful insights, challenging conventional beliefs about work, money, and happiness. Sabatier emphasizes the importance of redefining your relationship with wealth and creating multiple income streams to escape the rat race. With practical tips on budgeting, investing, and mindset shifts, readers are equipped to take bold steps toward their financial goals. Dive into this guide and discover the blueprint that could lead you to a life of true financial independence!

By Grant Sabatier

Published: 2020

"Financial freedom is available to those who learn about it and work for it."

The International Bestseller New York Public Library's "Top 10 Think Thrifty Reads of 2023" "This book blew my mind. More importantly, it made financial independence seem achievable. I read Financial Freedom three times, cover-to-cover." —Lifehacker Money is unlimited. Time is not. Become financially independent as fast as possible. In 2010, 24-year old Grant Sabatier woke up to find he had $2.26 in his bank account. Five years later, he had a net worth of over $1.25 million, and CNBC began calling him "the Millennial Millionaire." By age 30, he had reached financial independence. Along the way he uncovered that most of the accepted wisdom about money, work, and retirement is either incorrect, incomplete, or so old-school it's obsolete. Financial Freedom is a step-by-step path to make more money in less time, so you have more time for the things you love. It challenges the accepted narrative of spending decades working a traditional 9 to 5 job, pinching pennies, and finally earning the right to retirement at age 65, and instead offers readers an alternative: forget everything you've ever learned about money so that you can actually live the life you want. Sabatier offers surprising, counter-intuitive advice on topics such as how to: * Create profitable side hustles that you can turn into passive income streams or full-time businesses * Save money without giving up what makes you happy * Negotiate more out of your employer than you thought possible * Travel the world for less * Live for free--or better yet, make money on your living situation * Create a simple, money-making portfolio that only needs minor adjustments * Think creatively--there are so many ways to make money, but we don't see them. But most importantly, Sabatier highlights that, while one's ability to make money is limitless, one's time is not. There's also a limit to how much you can save, but not to how much money you can make. No one should spend precious years working at a job they dislike or worrying about how to make ends meet. Perhaps the biggest surprise: You need less money to "retire" at age 30 than you do at age 65. Financial Freedom is not merely a laundry list of advice to follow to get rich quick--it's a practical roadmap to living life on one's own terms, as soon as possible.

Showing 8 of 20 similar books

Bill Ackman is an American hedge fund manager and founder of Pershing Square Capital Management, known for his activist investing style. Ackman has been involved in high-profile investment battles, including his campaigns against companies like Herbalife and his successful turnaround of companies like Canadian Pacific Railway. He is known for taking bold, contrarian positions and for his ability to influence corporate governance through shareholder activism. Ackman’s investing philosophy focuses on long-term value creation, and he has become one of the most recognized figures in the finance world.

Lex Fridman is an artificial intelligence researcher, podcaster, and MIT professor, known for his work in autonomous vehicles, robotics, and deep learning. Fridman has gained widespread popularity through his podcast, Lex Fridman Podcast, where he interviews leading thinkers in science, technology, and philosophy, exploring topics like AI, consciousness, and the future of humanity. His academic work focuses on human-centered AI, aiming to create machines that can better understand and interact with humans. Fridman’s ability to distill complex topics into accessible conversations has earned him a large following, and his podcast is known for its thoughtful, in-depth discussions with some of the brightest minds of our time. He is also an advocate for the responsible development of AI, emphasizing the ethical implications of this rapidly advancing technology. Outside of academia and podcasting, Fridman is a practitioner of jiu-jitsu and frequently speaks about the importance of discipline and continuous learning.

Jan Losert is a visionary author and digital design expert, renowned for his contributions to the intersection of technology and creativity. His most significant work includes co-authoring "Design Systems Handbook," which has become a seminal guide for creating cohesive and efficient design frameworks. Losert's expertise extends to his role as a speaker and educator, where he passionately shares his insights on user experience and interface design. In addition to his literary achievements, he co-founded several successful startups, leveraging his deep understanding of design to drive innovation. His work continues to influence and inspire both emerging and established designers worldwide.

Andrew Lokenauth is a distinguished author and financial expert known for his insightful contributions to personal finance and investment literature. With a career spanning over a decade, he has written extensively on topics such as wealth management, financial planning, and market analysis. Lokenauth's works are celebrated for their clarity and practical advice, making complex financial concepts accessible to a broad audience. He has been featured in numerous financial publications and has established himself as a trusted voice in the industry. Beyond his writing, Lokenauth is also a sought-after speaker, sharing his expertise at various seminars and workshops.

Morgan Housel is a financial writer and partner at The Collaborative Fund, best known for his book The Psychology of Money. His work explores the behavioral side of finance, emphasizing how emotions, history, and decision-making impact wealth-building. Housel’s writing is widely praised for being accessible, insightful, and engaging, making complex financial topics easier to understand. He contributes regularly to financial publications and speaks at conferences on the power of long-term thinking in finance. His book has become a modern classic in the personal finance genre.

Sophia Amoruso is a prominent entrepreneur and author, best known for founding the women's fashion retailer Nasty Gal. She chronicled her journey from eBay seller to CEO in her New York Times bestselling memoir, "Girlboss," which inspired a Netflix series of the same name. Amoruso's work has empowered many young women in business, and she later launched Girlboss Media, a digital community for ambitious women. She has been recognized as one of the richest self-made women by Forbes. Beyond her business acumen, Amoruso's contributions to literature include her second book, "Nasty Galaxy," which combines personal anecdotes, style tips, and motivational advice.

Kevin Rose is a notable entrepreneur and technology investor, best known for founding Digg, a pioneering social news website that significantly influenced online content sharing. Although not primarily recognized for literary contributions, Rose has impacted digital media and online culture, which are recurring themes in contemporary literature on technology. His insights and experiences have been featured in various tech journals and books, enriching discussions on innovation and digital entrepreneurship. Rose also co-hosted the popular podcast "The Random Show" with Tim Ferriss, where he shares his thoughts on technology, health, and productivity. Through his ventures and public speaking, Rose continues to inspire narratives around the digital revolution and startup culture.

Blake Mycoskie is an American entrepreneur, author, and philanthropist best known for founding TOMS Shoes, a company that pioneered the "One for One" business model, donating a pair of shoes for every pair sold. His significant literary contribution includes the bestselling book "Start Something That Matters," which offers insights into social entrepreneurship and encourages readers to pursue meaningful ventures. Mycoskie's innovative approach to business has inspired a global movement toward corporate social responsibility. He has received numerous accolades for his work, including the Secretary of State's Award for Corporate Excellence. Mycoskie continues to influence the business world with his emphasis on purpose-driven enterprises.

Showing 8 of 23 related collections

“Financial freedom is available to those who learn about it and work for it.”

Financial Freedom

By Grant Sabatier

Discover a world of knowledge through our extensive collection of book summaries.

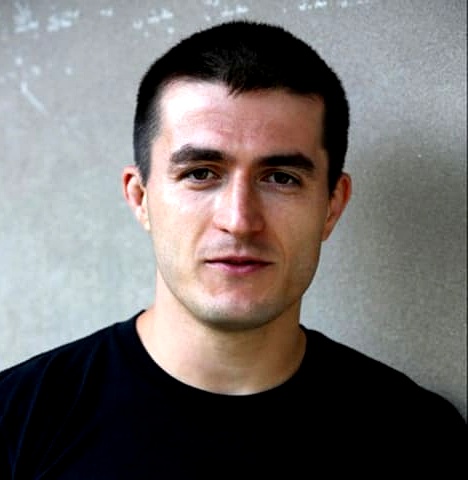

Grant Sabatier is a renowned author and financial expert best known for his book, "Financial Freedom: A Proven Path to All the Money You Will Ever Need." After achieving financial independence at just 30 years old, he has dedicated his career to helping others escape the conventional 9-to-5 grind and attain their own financial goals. Sabatier is the founder of Millennial Money, a popular personal finance website, where he shares insights on saving, investing, and entrepreneurship. He is a sought-after speaker and has been featured in major media outlets like Forbes, CNBC, and The New York Times. With a passion for empowering individuals through financial literacy, Grant continues to inspire a new generation to pursue financial wellness and freedom.

Key information about the book.

Support local bookstores: BookShop gives a portion of each sale to independent bookshops!

In "Cashflow Quadrant," Robert Kiyosaki introduces a revolutionary framework for understanding how wealth is generated and sustained. He delineates four distinct categories—Employee, Self-Employed, Business Owner, and Investor—that illustrate the pathways individuals can take toward financial freedom. With insights drawn from his own journey, Kiyosaki challenges conventional beliefs about work and money, encouraging readers to shift their mindsets and explore new possibilities. This engaging guide empowers you to evaluate your current position and make strategic transitions to enhance your financial future. Are you ready to discover which quadrant you're in and unlock your potential for wealth?

In "The Millionaire Next Door," Thomas J. Stanley and William D. Danko reveal surprising truths about the habits and lifestyles of America's wealthy. Rather than flashy spending, these millionaires embody frugality, discipline, and the pursuit of financial independence. Uncover the principles that distinguish the affluent from those who merely appear wealthy, and learn how everyday choices shape true wealth. Through eye-opening statistics and relatable anecdotes, this book dismantles common misconceptions about wealth. Are you ready to discover the secrets of those living quietly among us who have amassed true fortunes?

In "The Intelligent Investor," Benjamin Graham unveils timeless strategies for navigating the volatile world of investing with wisdom and discipline. He introduces the concept of value investing, teaching readers to distinguish between price and intrinsic value, all while emphasizing the importance of a defensive investment strategy. Graham’s insightful principles empower investors to cultivate emotional resilience, protecting them from the relentless whims of the market. With real-world anecdotes and practical advice, this classic remains a cornerstone for anyone seeking financial success and peace of mind. Dive in to discover how patience, rationality, and a solid plan can transform your investment journey!

In "Money: Master the Game," Tony Robbins unlocks the secrets to financial freedom through insights from legendary investors and his own transformative experiences. He presents a comprehensive blueprint that demystifies the world of finance, empowering readers to take control of their financial destinies. Packed with actionable strategies, Robbins reveals the psychological barriers that hold us back from wealth and how to overcome them. The book challenges conventional wisdom, urging readers to think differently about money and investing. Get ready to embark on an enlightening journey that could reshape your financial future forever!

The Money Book for the Young, Fabulous & Broke is your ultimate financial guide, tailored for those navigating the complexities of modern money management. With vibrant insights and relatable anecdotes, author Suze Orman empowers readers to take control of their finances while embracing their youthful exuberance. Discover essential tools for budgeting, saving, and investing, all designed to transform your financial future from daunting to dazzling. Orman’s candid advice challenges you to rethink your relationship with wealth and offers a blueprint for living fabulously, even on a budget. Are you ready to unlock the secrets to financial freedom and become fabulously secure?

In "Women & Money," Suze Orman empowers women to take control of their financial destinies with insightful advice and practical strategies. Through personal anecdotes and expert tips, she dismantles the societal myths that often hinder women's financial confidence. Orman explores the emotional connections to money, urging readers to embrace their worth and create a secure future. With a blend of tough love and encouragement, she offers a roadmap to financial independence that resonates deeply. Discover how understanding your relationship with money can transform not just your finances, but your entire life.

In "The Automatic Millionaire," David Bach unveils a powerful, no-nonsense financial strategy that promises to transform your wealth outlook without overwhelming effort. By advocating for automation in savings and investments, Bach highlights how small, consistent actions can lead to life-changing results. The book's engaging anecdotes and practical tips encourage readers to rethink their relationship with money. With an emphasis on establishing robust financial habits, it beckons you to discover the secrets of wealth-building while you sleep. Are you ready to unlock the door to financial freedom effortlessly?

In "The Latte Factor," personal finance expert David Bach unveils a transformative story that intertwines the journey of a young woman discovering the power of financial freedom. Through the lens of a seemingly simple daily ritual—her coffee habit—she learns profound lessons about saving and investing. With relatable characters and an engaging narrative, Bach challenges readers to rethink their spending habits and recognize the true cost of indulgences. Could a small shift in perspective lead to monumental changes in your financial future? Dive into this inspiring tale and unlock the secrets to achieving your dreams, one latte at a time!