Andrew Lokenauth's Book Recommendations

Andrew Lokenauth is a distinguished author and financial expert known for his insightful contributions to personal finance and investment literature. With a career spanning over a decade, he has written extensively on topics such as wealth management, financial planning, and market analysis. Lokenauth's works are celebrated for their clarity and practical advice, making complex financial concepts accessible to a broad audience. He has been featured in numerous financial publications and has established himself as a trusted voice in the industry. Beyond his writing, Lokenauth is also a sought-after speaker, sharing his expertise at various seminars and workshops.

Start Listening to Book Summary

Books in the Collection

Book Summaries

Freakonomics Book Summary

In 'Freakonomics,' Steven D. Levitt and Stephen J. Dubner explore the hidden side of everything, revealing the surprising truths behind human behavior and decision-making. Through a series of intriguing case studies, they uncover the economic forces that shape our lives in ways we never expected. What do schoolteachers and sumo wrestlers have in common? How do incentives drive the behavior of people in powerful positions? Prepare to challenge your assumptions and see the world through a lens of data and unconventional thinking.

Rich Dad Poor Dad Book Summary

In 'Rich Dad Poor Dad', Robert T. Kiyosaki contrasts the financial philosophies of his two father figures: his biological father (Poor Dad), who values traditional education and job security, and his best friend's father (Rich Dad), who advocates for financial literacy and investing. This compelling narrative reveals how mindset and education shape wealth acquisition and financial independence. Kiyosaki challenges conventional beliefs about money, urging readers to think beyond a paycheck and embrace entrepreneurship. Through personal anecdotes and practical advice, he ignites a rethinking of what it means to be rich. Are you ready to transform your financial future?

I Will Teach You to Be Rich, Second Edition Book Summary

In 'I Will Teach You to Be Rich, Second Edition,' Ramit Sethi provides a no-nonsense guide to mastering personal finance with a blend of humor and practicality. He challenges conventional money advice and introduces readers to a unique banking system for maximizing their savings. Through straightforward strategies, Sethi reveals how to automate finances and invest wisely for the long term. Each chapter brims with actionable tips that encourage readers to take control of their financial futures. With insights that delve deep into psychology and behavior, this book is a game-changer for anyone seeking to build real wealth.

One Up on Wall Street Book Summary

In 'One Up on Wall Street', legendary investor Peter S. Lynch shares his investment philosophy that empowers everyday individuals to confidently navigate the stock market. With insightful anecdotes and a no-nonsense approach, Lynch reveals how to identify promising companies before they become household names. He emphasizes the importance of doing your homework and investing in what you know, challenging traditional investment strategies. Lynch's compelling narrative demystifies stock picking, making it accessible to both novice and seasoned investors. Will you discover the secrets to outperforming Wall Street?

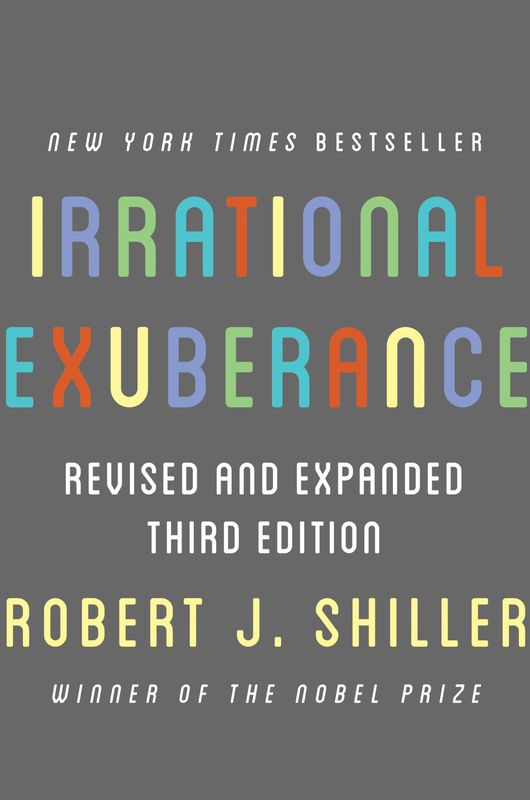

Irrational Exuberance Book Summary

In 'Irrational Exuberance,' Robert J. Shiller uncovers the volatile dynamics of financial markets and the psychological factors that drive investor behavior. He argues that emotional reactions often lead to market bubbles and crashes, challenging the conventional belief in rational market efficiency. Shiller's insightful analysis spans historical market trends, revealing how collective psychology can distort perceptions of value. With compelling evidence and engaging narratives, he prompts readers to rethink their understanding of risk and speculation. This groundbreaking work raises critical questions about the sustainability of economic growth and the true nature of investment decision-making.