In "The Black Swan," Nassim Nicholas Taleb explores the profound impact of rare and unpredictable events—those seemingly impossible occurrences that shape our world in transformative ways. He challenges conventional thinking, revealing how humans consistently underestimate uncertainty and overvalue what we can predict. Through compelling anecdotes and thought-provoking insights, Taleb illustrates how we can prepare for the unexpected rather than just cling to past experiences. The book urges readers to embrace randomness and rethink the frameworks we use to navigate life’s complexities. Will you recognize your own blind spots before the next Black Swan strikes?

By Nassim Nicholas Taleb

Published: 2010

"The Black Swan is a book by Nassim Nicholas Taleb. Here’s a quote from it: "What we see is all there is.""

The most influential book of the past seventy-five years: a groundbreaking exploration of everything we know about what we don’t know, now with a new section called “On Robustness and Fragility.” A black swan is a highly improbable event with three principal characteristics: It is unpredictable; it carries a massive impact; and, after the fact, we concoct an explanation that makes it appear less random, and more predictable, than it was. The astonishing success of Google was a black swan; so was 9/11. For Nassim Nicholas Taleb, black swans underlie almost everything about our world, from the rise of religions to events in our own personal lives. Why do we not acknowledge the phenomenon of black swans until after they occur? Part of the answer, according to Taleb, is that humans are hardwired to learn specifics when they should be focused on generalities. We concentrate on things we already know and time and time again fail to take into consideration what we don’t know. We are, therefore, unable to truly estimate opportunities, too vulnerable to the impulse to simplify, narrate, and categorize, and not open enough to rewarding those who can imagine the “impossible.” For years, Taleb has studied how we fool ourselves into thinking we know more than we actually do. We restrict our thinking to the irrelevant and inconsequential, while large events continue to surprise us and shape our world. In this revelatory book, Taleb will change the way you look at the world, and this second edition features a new philosophical and empirical essay, “On Robustness and Fragility,” which offers tools to navigate and exploit a Black Swan world. Taleb is a vastly entertaining writer, with wit, irreverence, and unusual stories to tell. He has a polymathic command of subjects ranging from cognitive science to business to probability theory. Elegant, startling, and universal in its applications, The Black Swan is a landmark book—itself a black swan.

Showing 8 of 28 similar books

Charlie Munger is an American investor, businessman, and philanthropist, best known as the vice chairman of Berkshire Hathaway, where he partners with Warren Buffett. Renowned for his insights on investment strategies and mental models, Munger has significantly influenced the world of finance. His notable literary contributions include "Poor Charlie's Almanack," a compilation of his speeches and writings that distill his wisdom on decision-making and business principles. Munger's work emphasizes the importance of multidisciplinary thinking and continuous learning. Beyond his financial acumen, he is celebrated for his charitable efforts, particularly in education and healthcare.

Ana Lorena Fabrega is an innovative educator and author passionate about reimagining education. Known as “Ms. Fab,” she is the Chief Evangelist at Synthesis, an education startup inspired by the problem-solving and collaboration model used at SpaceX. She advocates for alternative learning methods, encouraging curiosity and creativity in students. Ana's work emphasizes the importance of engaging young learners in real-world challenges and critical thinking. She also shares insights on education reform through her popular newsletter, Fab Fridays.

Nassim Nicholas Taleb is a Lebanese-American author, scholar, and risk analyst, best known for his work on uncertainty, probability, and risk. His books, including The Black Swan and Antifragile, explore how rare and unpredictable events shape the world and how individuals and systems can become more resilient to shocks. Taleb’s insights on risk management have influenced fields ranging from finance to medicine, and he is known for his outspoken criticism of conventional wisdom. His ideas about randomness, decision-making, and the limitations of human knowledge have made him a leading thinker in modern economics and philosophy.

Andrew Wilkinson is a distinguished author and entrepreneur, best known for his insightful business writings and contributions to the tech industry. He co-founded MetaLab, a prominent design agency that has shaped the user experience of major platforms like Slack and Coinbase. Wilkinson's entrepreneurial journey and his publications provide valuable perspectives on startup culture, innovation, and leadership. His writing, often featured in leading business magazines and his personal blog, has garnered a wide readership for its practical advice and engaging storytelling. Andrew continues to influence both literature and the business world with his unique blend of creativity and strategic thinking.

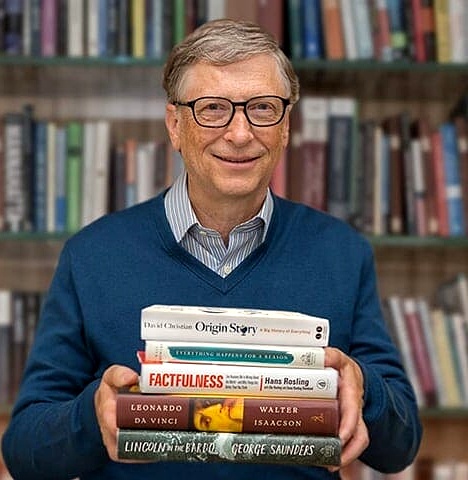

Bill Gates, co-founder of Microsoft Corporation, is a pioneering figure in the tech industry, having played a key role in the personal computer revolution. His work at Microsoft, particularly the development of Windows, transformed software and computing globally. Beyond his technology contributions, Gates is also a prolific author, with notable works such as "The Road Ahead" and "Business @ the Speed of Thought," which offer insights into the future of technology and business. Additionally, his philanthropic efforts through the Bill & Melinda Gates Foundation have had a profound impact on global health, education, and poverty. Gates continues to influence both technology and literature with his forward-thinking perspectives and innovative ideas.

Mark Manson is a best-selling author and personal development expert known for his candid and no-nonsense approach to self-help. His most notable work, "The Subtle Art of Not Giving a F*ck," has sold millions of copies worldwide and has been translated into numerous languages, resonating with readers for its practical advice and irreverent tone. Manson followed up with another successful book, "Everything Is F*cked: A Book About Hope," which further cemented his reputation as a thought leader in modern existentialism. In addition to his books, he runs a popular blog that delves into topics ranging from happiness to personal growth. His work has not only transformed the self-help genre but also influenced a global audience seeking authentic and actionable guidance.

“The Black Swan is a book by Nassim Nicholas Taleb. Here’s a quote from it: "What we see is all there is."”

The Black Swan

By Nassim Nicholas Taleb

Discover a world of knowledge through our extensive collection of book summaries.

Nassim Nicholas Taleb is a Lebanese-American philosopher, scholar, and financial trader, best known for his works on probability, uncertainty, and risk. He gained widespread recognition for his books, particularly "The Black Swan," which explores the impact of rare, unpredictable events on the world. Taleb has a background in mathematics and finance, having studied at the University of Pennsylvania and the University of Massachusetts. His ideas challenge conventional thinking, advocating for a more robust approach to dealing with uncertainty in various domains, from economics to life itself. In addition to his writing, he is known for his engaging and often provocative public speaking and for promoting the concept of "Antifragility," which describes systems that gain from disorder.

Key information about the book.

Support local bookstores: BookShop gives a portion of each sale to independent bookshops!

In "The Wealthy Gardener," author John Soforic reveals the transformative journey of a father teaching his son the intricate balance between wealth and wisdom. Through a series of poignant parables, readers explore the seeds of financial success that sprout from patience, dedication, and the right mindset. The book intertwines personal anecdotes with practical advice, challenging conventional notions of prosperity and fulfillment. As the characters navigate the gardens of their lives, they uncover profound truths about happiness, legacy, and the true meaning of wealth. Prepare to dig deep into a narrative that cultivates both inspiration and actionable insights for your own growth.

In "Financial Peace Revisited," renowned financial guru Dave Ramsey lays out a transformative blueprint for achieving financial independence and peace of mind. Through compelling personal anecdotes and straightforward principles, he demystifies budgeting and debt management, empowering readers to take control of their finances. Ramsey's seven-step plan not only promises to eliminate debt but also encourages a mindset shift towards saving and giving. With a blend of practical advice and motivational insights, he confronts common financial fears and inspires readers to envision a life free from money stress. Dive into this engaging guide and discover the keys to unlocking your financial freedom!

In "The Big Short," Michael Lewis unveils the hidden complexities of the 2008 financial crisis through the eyes of a few unconventional investors who saw disaster coming. As they bet against the housing market, these outsiders navigate Wall Street’s labyrinthine greed and negligence, exposing the flawed logic behind the crisis. With wit and suspense, Lewis reveals the shocking truth about the financial instruments that led to economic chaos. Readers will find themselves questioning the very foundations of finance while gripping the edge of their seats at the unfolding drama. Can a handful of mavericks really challenge the system, or are they just playing a dangerous game of chance?

In "Black Edge," investigative journalist Sheelah Kolhatkar delves into the high-stakes world of hedge funds and the enigmatic figure of Steven A. Cohen. As she unravels the saga of insider trading, greed, and Wall Street's murky ethics, the book pulls readers into a gripping tale of ambition that spans decades. With intellectual prowess and audacious risk-taking, Cohen's rise to power raises questions about the moral compass of finance. Kolhatkar's penetrating analysis unveils the dark side of wealth and the relentless pursuit of success, leaving readers questioning the true cost of ambition. Will you dare to uncover the secrets of a financial titan and the shadowy underworld they inhabit?

In 'The Outsiders,' William Thorndike reveals the captivating stories of unconventional leaders who defy the norms of Wall Street and common business wisdom. These mavericks, often overlooked or underestimated, demonstrate that true success comes from deep analytical thinking and a long-term vision. Through engaging case studies, Thorndike uncovers the secret principles that set these extraordinary outsiders apart from their peers. Readers are invited into a world where decision-making is grounded in value creation and discipline rather than mere trends. This thought-provoking exploration challenges conventional beliefs and beckons aspiring leaders to reassess their own paths to success.

In "The Soul of Discipline," Dr. Kim John Payne reveals the transformative power of self-discipline not just as a tool for children, but as a profound philosophy for parenting and education. Through compelling stories and practical strategies, he unveils how mindful guidance can lead to deeper connections and a calmer household. Discover the art of balancing freedom and structure, encouraging resilience while nurturing empathy. This book challenges conventional notions of discipline, urging readers to foster inner strength in their children. Are you ready to unlock the secrets to a more harmonious and empowered family life?

'Judgment in Managerial Decision Making' delves into the psychology behind how managers make decisions, often influenced by cognitive biases and errors. Bazerman and Moore reveal the surprising ways these biases can lead to poor outcomes, even among experienced leaders. With compelling real-world examples, the authors illustrate practical strategies to improve decision-making processes. This book challenges readers to recognize their own psychological blind spots. Dive into this insightful exploration and transform the way you approach critical decisions in your professional life!

Dive into 'Poor Charlie's Almanack,' where Charles T. Munger, the brilliant mind behind Berkshire Hathaway, shares his wealth of knowledge and unconventional wisdom. This compelling guide offers a treasure trove of insights on decision-making, investing, and life philosophy that challenges conventional thinking. Through a blend of humor and candor, Munger's reflections reveal the power of multidisciplinary thinking and mental models. With engaging anecdotes and practical advice, readers are encouraged to expand their intellectual horizons and apply these lessons in their own lives. Unlock the secrets to success and learn how to navigate the complexities of life with Munger's unique perspective!