The One Week Budget Book Summary

In 'The One Week Budget', Tiffany Aliche unveils a transformative approach to financial management that empowers readers to take control of their money in just seven days. With practical strategies and relatable anecdotes, she demystifies budgeting, making it accessible to everyone, regardless of their financial background. Aliche's engaging style encourages readers to face their financial fears head-on and embrace the freedom that comes with financial literacy. As you delve into her method, you'll discover how a week’s planning can change your financial future forever. Are you ready to embark on the journey to financial empowerment?

By Tiffany Aliche

Published: 2011

""Budgeting is not about limiting yourself - it's about making the things that excite you possible.""

Book Review of The One Week Budget

Hate paying bills? So do I, and that's why I stopped! What if I told you that I haven't paid a bill in almost six years! Do you want to know how I did it? With the help of Bella the Budgetnista, featured in this book, we will teach you what I took years to learn. The One Week Budget is for anyone that wants to manage their day-to-day money without the day-to-day trouble. Does this sound like you? What are you waiting for? Read the book! Tiffany "The Budgetnista" Aliche

Book Overview of The One Week Budget

About the Book Author

Tiffany Aliche

Tiffany Aliche, also known as 'The Budgetnista,' is a renowned financial educator and author specializing in personal finance and money management. With a passion for empowering individuals to take control of their financial lives, she has authored several bestselling books, including 'Get Good with Money' and 'The One Week Budget.' Aliche's writing is characterized by its approachable style, practical advice, and motivational tone, making complex financial concepts accessible to a wide audience. She is not only a sought-after speaker but also the founder of the Live Richard Academy, a community dedicated to financial literacy and personal empowerment.

Book Details

Key information about the book.

- Authors

- Tiffany Aliche

- Published

- January 2011

- Publisher

- Createspace Independent Publishing Platform

- ISBN

- 1453757228

- Language

- English

- Pages

- N/A

- Genres

- FinanceSelf-HelpBudgetingPersonal Finance

Purchase Options

Support local bookstores: BookShop gives a portion of each sale to independent bookshops!

Similar books you might like →

The Lies of Locke Lamora Book Summary

In "The Lies of Locke Lamora," master thief Locke Lamora navigates a treacherous world of intrigue and deception in the city of Camorr, where the line between friend and foe blurs. As he orchestrates elaborate heists with his band of con artists, known as the Gentleman Bastards, they are drawn into a deadly game with a sinister crime lord. Betrayal, wits, and a touch of mischief weave throughout this gripping tale, challenging Locke to outsmart both his enemies and his own crew. Amid the chaos, shocking revelations test their loyalties and the very bonds of friendship. Will Locke's cunning be enough to survive the lies that threaten to unravel everything he holds dear?

The 7 Habits of Highly Effective People Book Summary

In "The 7 Habits of Highly Effective People," Stephen R. Covey unveils a transformative framework for personal and professional success that goes beyond mere productivity. Through powerful principles that encourage self-mastery and proactive living, Covey guides readers to shift their paradigms and cultivate meaningful relationships. Each habit builds upon the last, leading to a holistic approach to achieving goals and overcoming challenges. As you journey through the chapters, you'll discover practical strategies that foster resilience and interdependence. Are you ready to unlock the secrets of effectiveness and redefine what it means to thrive in a complex world?

The Alchemist Book Summary

In "The Alchemist," Paulo Coelho weaves a mesmerizing tale of Santiago, a young shepherd who dreams of discovering his personal legend. Driven by an insatiable quest for treasure, he embarks on a transformative journey across deserts and cultures, encountering wise mentors and mystical omens along the way. Each encounter unveils profound truths about destiny, love, and the interconnectedness of all things. As Santiago wrestles with fears and realizations, readers are invited to reflect on their own paths and the dreams they hold dear. Will he find the treasure he seeks, or will the journey itself become the ultimate reward?

The Money Book for the Young, Fabulous & Broke Book Summary

The Money Book for the Young, Fabulous & Broke is your ultimate financial guide, tailored for those navigating the complexities of modern money management. With vibrant insights and relatable anecdotes, author Suze Orman empowers readers to take control of their finances while embracing their youthful exuberance. Discover essential tools for budgeting, saving, and investing, all designed to transform your financial future from daunting to dazzling. Orman’s candid advice challenges you to rethink your relationship with wealth and offers a blueprint for living fabulously, even on a budget. Are you ready to unlock the secrets to financial freedom and become fabulously secure?

Nine Steps to Financial Freedom Book Summary

In "The 9 Steps to Financial Freedom," author Suze Orman unveils a transformative blueprint that empowers readers to take control of their financial lives. This compelling guide combines practical strategies with profound mindset shifts, encouraging individuals to confront their fears and embrace their worth. Each step is designed to dismantle barriers to wealth and instill lasting security, guiding readers from financial confusion to clarity. Through relatable anecdotes and actionable advice, Orman inspires a journey of self-discovery and financial empowerment. Are you ready to unlock the secrets to true financial freedom?

The Ultimate Retirement Guide for 50+ Book Summary

In "Suze Orman’s Retirement Revolution," financial guru Suze Orman redefines what it means to plan for a secure future. With a no-nonsense approach, she challenges conventional wisdom and offers practical strategies to empower readers to take control of their retirement savings. Orman delves into the emotional aspects of money, urging us to confront our fears and dreams about aging and financial security. Through real-life stories and actionable advice, she illuminates the path to an abundant retirement. Are you ready to revolutionize your financial future and embrace the retirement you deserve?

The Money Class Book Summary

In "The Money Class," Suze Orman redefines financial literacy in a world where traditional rules no longer apply. She reveals the secrets to navigating modern economic challenges, providing actionable advice on saving, investing, and building wealth. Orman emphasizes the importance of understanding your personal values and translating them into financial choices. With relatable stories and practical tips, she empowers readers to take control of their financial futures. Are you ready to transform your relationship with money and unlock the life you deserve?

The Automatic Millionaire Book Summary

In "The Automatic Millionaire," David Bach unveils a powerful, no-nonsense financial strategy that promises to transform your wealth outlook without overwhelming effort. By advocating for automation in savings and investments, Bach highlights how small, consistent actions can lead to life-changing results. The book's engaging anecdotes and practical tips encourage readers to rethink their relationship with money. With an emphasis on establishing robust financial habits, it beckons you to discover the secrets of wealth-building while you sleep. Are you ready to unlock the door to financial freedom effortlessly?

Showing 8 of 28 similar books

Similar Book Recommendations →

David Bach's Book Recommendations

David Bach is a financial expert and bestselling author known for his Finish Rich book series, including The Automatic Millionaire. He has made a career out of teaching people how to build wealth through small, manageable financial habits like “paying yourself first” and automating savings. His approach to personal finance is accessible and focuses on helping everyday individuals achieve long-term financial security. David has appeared on numerous media platforms, advocating for financial literacy and encouraging people to take control of their financial futures.

Ramsey Dave's Book Recommendations

Dave Ramsey is a personal finance expert, radio host, and bestselling author known for his book The Total Money Makeover. He advocates for debt-free living and offers practical advice on budgeting, saving, and investing. Ramsey’s popular radio show, The Dave Ramsey Show, has reached millions of listeners, where he provides real-world financial advice and helps individuals achieve financial peace. His Baby Steps method for eliminating debt and building wealth has become a cornerstone of his teachings. Ramsey’s work has made him one of the most well-known financial educators in the U.S.

Tony Robbins's Book Recommendations

Tony Robbins is a life coach, motivational speaker, and bestselling author known for his self-help books, including Awaken the Giant Within and Unlimited Power. He has worked with athletes, business leaders, and world figures to help them maximize their potential. Robbins is known for his dynamic seminars and workshops, where he teaches people strategies for achieving personal and professional success. His focus on emotional mastery, peak performance, and financial independence has made him a global leader in the self-improvement industry. Robbins has built a multi-million dollar business empire around his personal development programs.

Graham Stephan's Book Recommendations

Graham Stephan is a prominent real estate investor, YouTuber, and personal finance guru known for his insightful content on financial independence and investment strategies. He began his career in real estate at the age of 18 and quickly rose to prominence, amassing a multi-million-dollar portfolio. Stephan's YouTube channel, which boasts millions of subscribers, offers accessible and practical advice on budgeting, saving, and investing, earning him widespread acclaim and a dedicated following. In addition to his online presence, he has been featured in numerous high-profile publications and media outlets, solidifying his status as an influential figure in personal finance education. Through his work, Stephan has empowered countless individuals to take control of their finances and pursue financial freedom.

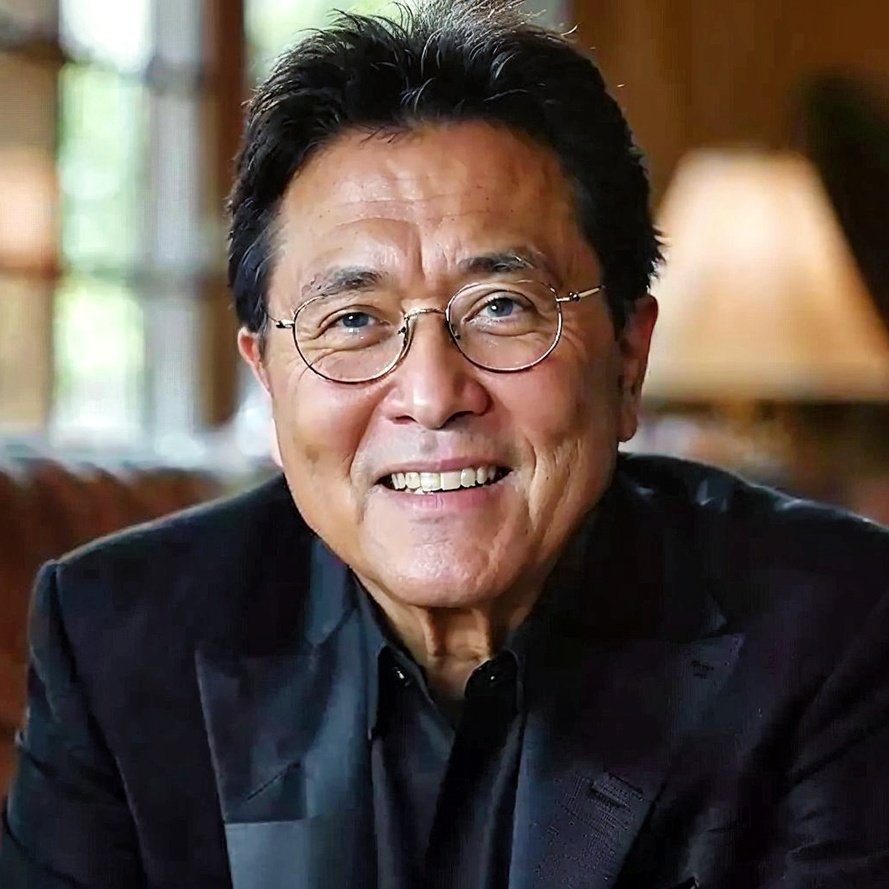

Robert Kiyosaki's Book Recommendations

Robert Kiyosaki is the author of the bestselling personal finance book Rich Dad Poor Dad, which challenges conventional wisdom on wealth building and financial literacy. He is a self-made entrepreneur and investor who emphasizes the importance of financial education and investing in assets that generate passive income. His Rich Dad brand has expanded to include books, seminars, and a board game that teaches financial principles. Kiyosaki advocates for self-reliance and encourages individuals to break free from the traditional “employee mindset.” He continues to teach people how to achieve financial independence.

The Barefoot Investor's Book Recommendations

Scott Pape, known as The Barefoot Investor, is an Australian financial advisor and author, best known for his best-selling book The Barefoot Investor: The Only Money Guide You’ll Ever Need. Pape’s simple, no-nonsense approach to personal finance has helped millions of Australians get out of debt, build savings, and invest for the future. His advice is based on practical, straightforward strategies that focus on budgeting, long-term investments, and financial independence. Pape’s work as a financial educator has made him one of the most trusted voices in personal finance, and his book has become one of the most successful financial guides in Australia.

“"Budgeting is not about limiting yourself - it's about making the things that excite you possible."”

The One Week Budget

By Tiffany Aliche

Frequently Asked Questions

Explore Our Catalogue

Discover a world of knowledge through our extensive collection of book summaries.

Genres

Genres

Genres

Featured Collections

- Top Book Club Picks

- One-Stop Nutrition

- Summer Reads 2024

- Best Beach Reads 2024

- Work-Life Balance Guide

- Time Management

- Healthy Foods

- Entrepreneur Toolkit

- Mind & Body Wellness

- Future Tech Insights

- Leadership Essentials

- Financial Freedom

- Sci-Fi Masterpieces

- Parenting 101

- Books That Became Blockbusters

- Guide to a Healthy Pregnancy