In 'The Kelly Capital Growth Investment Criterion', Leonard C. MacLean, Edward O. Thorp, and William T. Ziemba unveil a revolutionary investment strategy that maximizes capital growth and minimizes risk. Their insightful analysis combines mathematical rigor with practical investment principles, making it an essential read for serious investors. Discover how the Kelly criterion can transform your approach to betting and stock market investments alike. This book not only challenges conventional wisdom but also provides a blueprint for attaining financial success. Are you ready to rethink your investment strategies and harness the power of growth?

By Leonard C. MacLean, Edward O. Thorp, William T. Ziemba

Published: 2012

"Investment success doesn't merely rest on the assets we choose, but on our understanding of the balance between risk and reward."

Showing 8 of 25 similar books

Niki Scevak is a distinguished entrepreneur and venture capitalist, widely recognized for his contributions to the startup ecosystem rather than traditional literature. As a co-founder and partner at Blackbird Ventures, he has played a pivotal role in funding and mentoring successful Australian tech startups. Scevak also co-founded Startmate, an influential accelerator program that has shaped numerous early-stage companies. His work has significantly impacted the Australian tech landscape, fostering innovation and entrepreneurial growth. Though not an author of traditional books, his insights and thought leadership are frequently shared through industry publications and speaking engagements.

James Clear is the author of the bestselling book Atomic Habits, which focuses on the power of small habits and incremental improvements to achieve significant personal and professional growth. Clear’s writing blends insights from psychology, neuroscience, and productivity to provide practical strategies for building better habits. His work has helped millions of people create positive changes in their lives by focusing on the process rather than the outcome. James’s clear, actionable advice has made him a sought-after speaker and thought leader in the field of personal development.

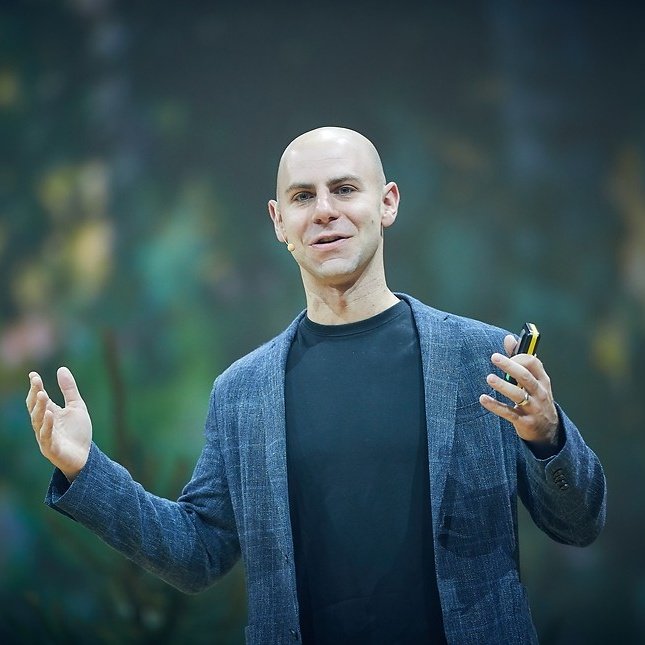

Adam Grant is a renowned organizational psychologist and bestselling author, celebrated for his influential work on motivation and workplace dynamics. He is a professor at the Wharton School of the University of Pennsylvania, where he has been the youngest tenured professor and earned numerous teaching awards. Grant's books, including "Give and Take," "Originals," and "Think Again," have been translated into multiple languages and have topped bestseller lists worldwide. His research and insights are frequently featured in major media outlets, and he hosts the popular podcast "WorkLife." Through his writing and speaking, Grant has profoundly impacted the fields of psychology, business, and education.

Bernie Sanders is an American politician and U.S. Senator from Vermont, known for his progressive policies and his advocacy for economic equality. Sanders ran for the Democratic presidential nomination in 2016 and 2020, inspiring a movement with his calls for Medicare for All, free college tuition, and a $15 minimum wage. He identifies as a democratic socialist and has been a long-standing advocate for labor rights, environmental justice, and social welfare programs. Sanders’ candidacy energized a new generation of activists and has had a lasting influence on the direction of the Democratic Party. His focus on income inequality and social justice continues to shape political discourse in the U.S.

Jamie Dimon is an American business executive, best known as the Chairman and CEO of JPMorgan Chase, one of the largest and most influential financial institutions in the world. Dimon has led JPMorgan through multiple economic crises, including the 2008 financial crash, and has consistently been recognized for his leadership in the banking industry. Under his tenure, JPMorgan has grown into a global financial powerhouse, focusing on innovation and sustainability. Dimon is also an advocate for corporate responsibility and frequently speaks on economic and regulatory issues. His leadership style and strategic insights have earned him widespread respect in the business world.

Suze Orman is a financial expert, television host, and author known for her straight-talking advice on personal finance. Her books, including The 9 Steps to Financial Freedom and Women & Money, have helped millions of people take control of their finances. Orman is a fierce advocate for financial empowerment, especially for women, and has appeared on numerous talk shows and news programs to share her advice. She emphasizes saving, investing, and avoiding debt to achieve long-term financial security. Suze continues to be a leading voice in personal finance education.

Bill Ackman is an American hedge fund manager and founder of Pershing Square Capital Management, known for his activist investing style. Ackman has been involved in high-profile investment battles, including his campaigns against companies like Herbalife and his successful turnaround of companies like Canadian Pacific Railway. He is known for taking bold, contrarian positions and for his ability to influence corporate governance through shareholder activism. Ackman’s investing philosophy focuses on long-term value creation, and he has become one of the most recognized figures in the finance world.

Arianna Huffington is the founder of The Huffington Post and Thrive Global, a company focused on wellness and productivity. She is a bestselling author and prominent speaker on the importance of sleep and managing stress. Arianna’s work emphasizes the importance of balance between professional success and personal well-being. Her book The Sleep Revolution has inspired a global movement to prioritize rest. She is considered one of the most influential women in media and business.

Showing 8 of 22 related collections

“Investment success doesn't merely rest on the assets we choose, but on our understanding of the balance between risk and reward.”

The Kelly Capital Growth Investment Criterion

By Leonard C. MacLean, Edward O. Thorp, William T. Ziemba

Discover a world of knowledge through our extensive collection of book summaries.

Leonard C. MacLean is an esteemed author known for his compelling narratives and ingenious storytelling. His notable works include 'The Whispering Woods,' a haunting exploration of nature and the human spirit, and 'Shadows of the Past,' which delves into the complexities of memory and regret. MacLean's writing style is characterized by rich, evocative prose and a strong sense of place, drawing readers into vividly realized worlds. Through his novels, he skillfully blends elements of mystery and psychological drama, making him a distinctive voice in contemporary literature.

Edward O. Thorp is a renowned mathematician, author, and hedge fund manager, best known for his pioneering work in the fields of both gambling and finance. Born on August 14, 1932, Thorp gained national recognition with his groundbreaking book, 'Beat the Dealer,' published in 1962, which introduced the concept of card counting in blackjack and transformed the game into a strategic endeavor. He followed this success with 'Beat the Market,' where he applied his mathematical expertise to the stock market, showcasing strategies that could achieve consistent returns. Thorp's writing is characterized by clarity, analytical rigor, and a practical approach, making complex concepts accessible to both novices and seasoned professionals. Throughout his career, he has been a strong advocate for the application of mathematical principles in everyday decision-making and investment strategies.

William T. Ziemba is a distinguished author and researcher known for his contributions to the fields of finance and operations research. He is particularly recognized for his works in optimization and decision-making processes. Notable publications include 'Handbook of Asset and Liability Management' and 'Mathematical Methods in Risk Analysis', where he explores the intricate balance between risk and return in financial contexts. Ziemba's writing style is characterized by its analytical rigor and practical applicability, making complex concepts accessible to both academics and practitioners.

Key information about the book.

Support local bookstores: BookShop gives a portion of each sale to independent bookshops!

In a dystopian future, Katniss Everdeen volunteers to take her sister's place in a brutal televised competition known as the Hunger Games, where only one victor can survive. As she navigates the treacherous arena filled with deadly foes and oppressive government forces, her resourcefulness and instincts are put to the ultimate test. Alliances form, betrayals loom, and the line between survival and morality blurs in the fight for freedom. With each turn of the page, readers are drawn deeper into a gripping tale of courage, sacrifice, and the quest for justice. Will Katniss's defiance spark a revolution, or will she become another pawn in a deadly game?

In "The Name of the Wind," follow Kvothe, a gifted young man with a tumultuous past, as he weaves his extraordinary life story. From his harrowing childhood as a traveling performer to his years at an elite university, Kvothe's journey is filled with magic, music, and mystery. As he seeks to uncover the truth behind the legendary beings known as the Chandrian, he grapples with love, loss, and the weight of his own destiny. With each page, the line between myth and reality blurs, revealing the man behind the legend. Prepare to be captivated by a tale that explores the power of storytelling itself, leaving you yearning for more as the secrets of Kvothe's world unfold.

In "The Lies of Locke Lamora," master thief Locke Lamora navigates a treacherous world of intrigue and deception in the city of Camorr, where the line between friend and foe blurs. As he orchestrates elaborate heists with his band of con artists, known as the Gentleman Bastards, they are drawn into a deadly game with a sinister crime lord. Betrayal, wits, and a touch of mischief weave throughout this gripping tale, challenging Locke to outsmart both his enemies and his own crew. Amid the chaos, shocking revelations test their loyalties and the very bonds of friendship. Will Locke's cunning be enough to survive the lies that threaten to unravel everything he holds dear?

No summary available

In "The Millionaire Next Door," Thomas J. Stanley and William D. Danko reveal surprising truths about the habits and lifestyles of America's wealthy. Rather than flashy spending, these millionaires embody frugality, discipline, and the pursuit of financial independence. Uncover the principles that distinguish the affluent from those who merely appear wealthy, and learn how everyday choices shape true wealth. Through eye-opening statistics and relatable anecdotes, this book dismantles common misconceptions about wealth. Are you ready to discover the secrets of those living quietly among us who have amassed true fortunes?

In "The Intelligent Investor," Benjamin Graham unveils timeless strategies for navigating the volatile world of investing with wisdom and discipline. He introduces the concept of value investing, teaching readers to distinguish between price and intrinsic value, all while emphasizing the importance of a defensive investment strategy. Graham’s insightful principles empower investors to cultivate emotional resilience, protecting them from the relentless whims of the market. With real-world anecdotes and practical advice, this classic remains a cornerstone for anyone seeking financial success and peace of mind. Dive in to discover how patience, rationality, and a solid plan can transform your investment journey!

In "The Culture Code," Daniel Coyle unveils the secrets behind the most successful teams, revealing that a strong culture isn't just a byproduct but a deliberate construct. Through fascinating stories from diverse organizations, he identifies three essential skills that foster trust and cooperation. Coyle's insights challenge conventional wisdom, suggesting that vulnerability, belonging, and purpose are the keystones of high-performing groups. With practical tips and compelling examples, he guides readers in transforming their own teams into thriving, connected units. Dive into this engaging exploration and discover how to unlock the hidden potential within your own culture!

In "The 7 Habits of Highly Effective People," Stephen R. Covey unveils a transformative framework for personal and professional success that goes beyond mere productivity. Through powerful principles that encourage self-mastery and proactive living, Covey guides readers to shift their paradigms and cultivate meaningful relationships. Each habit builds upon the last, leading to a holistic approach to achieving goals and overcoming challenges. As you journey through the chapters, you'll discover practical strategies that foster resilience and interdependence. Are you ready to unlock the secrets of effectiveness and redefine what it means to thrive in a complex world?