The Physics of Wall Street Book Summary

In 'The Physics of Wall Street', James Owen Weatherall explores the intriguing intersection between finance and physics, revealing how mathematical theories and models shape our understanding of financial markets. The book uncovers the pivotal roles that concepts like chaos theory and probability play in the quest for market predictions. Weatherall challenges the traditional views of finance, asking whether the certainty that physicists rely on is ever achievable in the unpredictable world of stocks and trades. With captivating anecdotes and insights from both disciplines, readers are drawn into a narrative that is equal parts informative and thought-provoking. Are markets truly a dance of deterministic patterns, or are they forever shrouded in uncertainty?

By James Owen Weatherall

Published: 2013

"In the grand tapestry of finance, the threads of mathematics and physics weave together truths that can help us navigate the chaos of the markets."

Book Review of The Physics of Wall Street

A young scholar tells the story of the physicists and mathematicians who created the models that have become the basis of modern finance and argues that these models are the "solution" to--not the source of--our current economic woes.

Book Overview of The Physics of Wall Street

About the Book Author

James Owen Weatherall

James Owen Weatherall is an acclaimed author and professor known for his insightful explorations of science and philosophy. He is the author of several notable works, including 'The Physics of Wall Street' and 'The Mysterious Fractal Fluid', where he skillfully blends complex scientific concepts with accessible prose. Weatherall's writing style is characterized by its clarity, wit, and ability to engage a broad audience in deep intellectual discussions. His works often tackle themes related to probability, decision-making, and the intersection of science and everyday life.

Book Details

Key information about the book.

- Authors

- James Owen Weatherall

- Published

- January 2013

- Publisher

- Houghton Mifflin Harcourt

- ISBN

- 0547317271

- Language

- English

- Pages

- 309

- Genres

- FinanceFinancial Literacy for KidsBehavioral FinanceScience and Nature

Purchase Options

Support local bookstores: BookShop gives a portion of each sale to independent bookshops!

Similar books you might like →

Black Edge Book Summary

In "Black Edge," investigative journalist Sheelah Kolhatkar delves into the high-stakes world of hedge funds and the enigmatic figure of Steven A. Cohen. As she unravels the saga of insider trading, greed, and Wall Street's murky ethics, the book pulls readers into a gripping tale of ambition that spans decades. With intellectual prowess and audacious risk-taking, Cohen's rise to power raises questions about the moral compass of finance. Kolhatkar's penetrating analysis unveils the dark side of wealth and the relentless pursuit of success, leaving readers questioning the true cost of ambition. Will you dare to uncover the secrets of a financial titan and the shadowy underworld they inhabit?

The Essays of Warren Buffett Book Summary

In "The Essays of Warren Buffett," the legendary investor distills decades of wisdom into a compelling collection of insights on investing, business, and life. Through a series of thought-provoking essays, Buffett shares his unique perspective on risk, value, and the importance of patience in the tumultuous world of finance. His distinctive voice combines humor with profound lessons, making complex concepts accessible to both novice investors and seasoned pros. As you delve into his reflections, you'll uncover the principles that have guided his success and how they can be applied to your own financial journey. Prepare to be inspired and challenged to rethink your approach to investing and wealth-building!

The Physics of Wall Street Book Summary

In 'The Physics of Wall Street', James Owen Weatherall explores the intriguing intersection between finance and physics, revealing how mathematical theories and models shape our understanding of financial markets. The book uncovers the pivotal roles that concepts like chaos theory and probability play in the quest for market predictions. Weatherall challenges the traditional views of finance, asking whether the certainty that physicists rely on is ever achievable in the unpredictable world of stocks and trades. With captivating anecdotes and insights from both disciplines, readers are drawn into a narrative that is equal parts informative and thought-provoking. Are markets truly a dance of deterministic patterns, or are they forever shrouded in uncertainty?

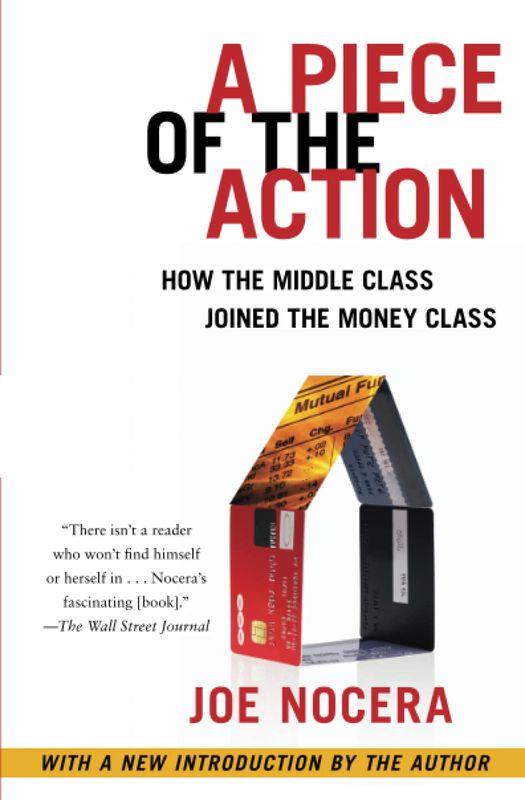

A Piece of the Action Book Summary

In 'A Piece of the Action,' Joe Nocera reveals the mesmerizing world behind the scenes of the modern financial markets. With sharp wit and comprehensive research, he exposes the ambitions, egos, and machinations of Wall Street's key players. The narrative intricately weaves personal anecdotes with broader economic trends, offering readers a captivating glimpse into the high-stakes game of finance. Nocera not only chronicles the chaos and conflicts but also delves into the ethical quandaries that shape our economy. This compelling exploration leaves readers questioning: who truly benefits from the systems in place, and at what cost?

The Statistical Mechanics of Financial Markets Book Summary

Dive into the captivating fusion of physics and finance in 'The Statistical Mechanics of Financial Markets' by Johannes Voit. This innovative book explores how statistical mechanics can unveil the hidden dynamics of financial markets, illuminating their often chaotic behavior. Voit masterfully translates complex scientific concepts into insights that can redefine your understanding of market fluctuations. Discover how the principles of thermodynamics can be applied to market behavior, challenging conventional economic theories. Prepare to see finance through a revolutionary lens that bridges the gap between science and economic prediction!

Financial Derivatives Book Summary

"Financial Derivatives" by Jamil Baz and George Chacko unveils the intricate world of financial instruments that derive their value from an underlying asset. This comprehensive guide delves into the mechanics of derivatives, exploring their use in hedging, speculation, and risk management. With real-world examples and expert insights, the authors illuminate complex concepts in a digestible format. Readers will discover how derivatives can be both a powerful tool for investors and a source of potential pitfalls. Unlock the secrets of modern finance and gain a deeper understanding of how derivatives shape the global economy.

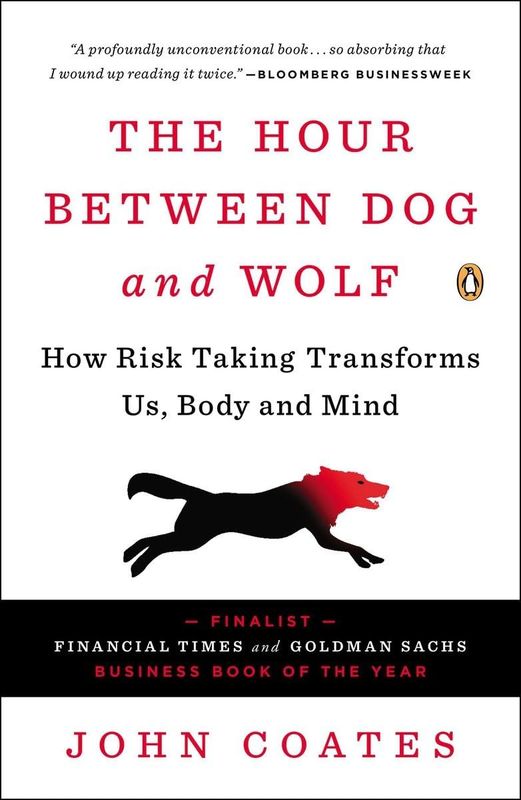

The Hour Between Dog and Wolf Book Summary

In 'The Hour Between Dog and Wolf,' John Coates explores the intriguing intersection of finance and biology, revealing how our primal instincts shape our decision-making in high-stakes environments. As he delves into the psychological and physiological effects of risk-taking, Coates uncovers why some investors thrive while others falter. Rich with insights from neuroscience, the book challenges conventional wisdom about the rationality of market behavior. Readers are invited to question how their own instincts play a role in their professional lives. Prepare to see the world of finance through a completely new lens, where biology meets Wall Street.

The Status Syndrome Book Summary

In 'The Status Syndrome', Michael Marmot reveals the profound impact of social status on health and well-being. He explores how one's place in the societal hierarchy influences everything from stress levels to life expectancy. Marmot challenges the reader to reconsider the definitions of health, success, and happiness through the lens of societal position. With gripping case studies and compelling research, he illuminates the urgent need for policy changes that address social inequalities. Prepare to question what truly defines a fulfilling life as you uncover the hidden forces that dictate our health outcomes.

Showing 8 of 24 similar books

Similar Book Recommendations →

Marc Andreessen's Book Recommendations

Marc Andreessen is an American entrepreneur, software engineer, and venture capitalist, best known for co-creating the Mosaic web browser, the first widely-used web browser, and co-founding Netscape. Andreessen is also the co-founder of Andreessen Horowitz, one of Silicon Valley’s most prominent venture capital firms, where he invests in groundbreaking technology companies like Facebook, Airbnb, and Coinbase. He is a thought leader on the impact of technology and innovation, often sharing his views on the future of the internet and startups. His contributions to the development of the web and the tech ecosystem have made him one of the most influential figures in technology.

Robert Kiyosaki's Book Recommendations

Robert Kiyosaki is the author of the bestselling personal finance book Rich Dad Poor Dad, which challenges conventional wisdom on wealth building and financial literacy. He is a self-made entrepreneur and investor who emphasizes the importance of financial education and investing in assets that generate passive income. His Rich Dad brand has expanded to include books, seminars, and a board game that teaches financial principles. Kiyosaki advocates for self-reliance and encourages individuals to break free from the traditional “employee mindset.” He continues to teach people how to achieve financial independence.

Andrew Wilkinson's Book Recommendations

Andrew Wilkinson is a distinguished author and entrepreneur, best known for his insightful business writings and contributions to the tech industry. He co-founded MetaLab, a prominent design agency that has shaped the user experience of major platforms like Slack and Coinbase. Wilkinson's entrepreneurial journey and his publications provide valuable perspectives on startup culture, innovation, and leadership. His writing, often featured in leading business magazines and his personal blog, has garnered a wide readership for its practical advice and engaging storytelling. Andrew continues to influence both literature and the business world with his unique blend of creativity and strategic thinking.

Malcolm Gladwell's Book Recommendations

Malcolm Gladwell is a Canadian journalist, author, and public speaker, best known for his best-selling books The Tipping Point, Outliers, and Blink. Gladwell’s work often explores the hidden patterns behind success, decision-making, and social phenomena, using storytelling to make complex ideas accessible to a wide audience. He has written extensively for The New Yorker and hosts the popular podcast Revisionist History, where he reexamines overlooked or misunderstood events in history. Gladwell is known for his ability to challenge conventional wisdom and provoke new ways of thinking about human behavior and societal trends.

Eric Weinstein's Book Recommendations

Eric Weinstein is an accomplished American mathematician, economist, and writer, known for his influential work in the fields of geometric unity and economic theory. As the Managing Director of Thiel Capital, he has significantly impacted the financial and technological sectors. Weinstein is also renowned for his thought-provoking discussions on the podcast "The Portal," where he explores complex scientific and social issues. He has written extensively on a variety of topics, contributing to both academic and popular literature. His unique perspectives and interdisciplinary approach have earned him recognition as a leading intellectual voice of his generation.

Bill Gates's Book Recommendations

Bill Gates, co-founder of Microsoft Corporation, is a pioneering figure in the tech industry, having played a key role in the personal computer revolution. His work at Microsoft, particularly the development of Windows, transformed software and computing globally. Beyond his technology contributions, Gates is also a prolific author, with notable works such as "The Road Ahead" and "Business @ the Speed of Thought," which offer insights into the future of technology and business. Additionally, his philanthropic efforts through the Bill & Melinda Gates Foundation have had a profound impact on global health, education, and poverty. Gates continues to influence both technology and literature with his forward-thinking perspectives and innovative ideas.

James Clear's Book Recommendations

James Clear is the author of the bestselling book Atomic Habits, which focuses on the power of small habits and incremental improvements to achieve significant personal and professional growth. Clear’s writing blends insights from psychology, neuroscience, and productivity to provide practical strategies for building better habits. His work has helped millions of people create positive changes in their lives by focusing on the process rather than the outcome. James’s clear, actionable advice has made him a sought-after speaker and thought leader in the field of personal development.

Sheryl Sandberg's Book Recommendations

Sheryl Sandberg is the COO of Meta (formerly Facebook) and the author of the bestselling book Lean In, which encourages women to pursue leadership roles and create gender equality in the workplace. She is a prominent advocate for women’s rights, particularly in corporate environments, and has launched initiatives to support women’s empowerment globally. Sheryl’s leadership at Facebook helped the company grow into one of the world’s largest social media platforms. She is also the founder of LeanIn.Org, a nonprofit dedicated to empowering women.

Showing 8 of 11 related collections

“In the grand tapestry of finance, the threads of mathematics and physics weave together truths that can help us navigate the chaos of the markets.”

The Physics of Wall Street

By James Owen Weatherall

Frequently Asked Questions

Explore Our Catalogue

Discover a world of knowledge through our extensive collection of book summaries.

Genres

Genres

Genres

Featured Collections

- Top Book Club Picks

- One-Stop Nutrition

- Summer Reads 2024

- Best Beach Reads 2024

- Work-Life Balance Guide

- Time Management

- Healthy Foods

- Entrepreneur Toolkit

- Mind & Body Wellness

- Future Tech Insights

- Leadership Essentials

- Financial Freedom

- Sci-Fi Masterpieces

- Parenting 101

- Books That Became Blockbusters

- Guide to a Healthy Pregnancy