When Genius Failed chronicles the dramatic rise and fall of Long-Term Capital Management, a hedge fund that boasted an elite team of financial wizards. As it navigates the complexities of high-stakes finance and groundbreaking quantitative models, the book unveils how overconfidence in genius can lead to catastrophic consequences. When the Asian financial crisis strikes, the fund’s intricate strategies unravel, threatening the global economy. Authors Roger Lowenstein masterfully intertwine personal narratives with economic theory, revealing the fragile balance between risk and reward. This gripping tale serves as a cautionary reminder that brilliance can blind us to the dangers lurking beneath the surface.

By Roger Lowenstein

Published: 2001

"When Genius Failed: The Rise and Fall of Long-Term Capital Management by Roger Lowenstein explores the complexities of finance and risk."

“A riveting account that reaches beyond the market landscape to say something universal about risk and triumph, about hubris and failure.”—The New York Times NAMED ONE OF THE BEST BOOKS OF THE YEAR BY BUSINESSWEEK In this business classic—now with a new Afterword in which the author draws parallels to the recent financial crisis—Roger Lowenstein captures the gripping roller-coaster ride of Long-Term Capital Management. Drawing on confidential internal memos and interviews with dozens of key players, Lowenstein explains not just how the fund made and lost its money but also how the personalities of Long-Term’s partners, the arrogance of their mathematical certainties, and the culture of Wall Street itself contributed to both their rise and their fall. When it was founded in 1993, Long-Term was hailed as the most impressive hedge fund in history. But after four years in which the firm dazzled Wall Street as a $100 billion moneymaking juggernaut, it suddenly suffered catastrophic losses that jeopardized not only the biggest banks on Wall Street but the stability of the financial system itself. The dramatic story of Long-Term’s fall is now a chilling harbinger of the crisis that would strike all of Wall Street, from Lehman Brothers to AIG, a decade later. In his new Afterword, Lowenstein shows that LTCM’s implosion should be seen not as a one-off drama but as a template for market meltdowns in an age of instability—and as a wake-up call that Wall Street and government alike tragically ignored. Praise for When Genius Failed “[Roger] Lowenstein has written a squalid and fascinating tale of world-class greed and, above all, hubris.”—BusinessWeek “Compelling . . . The fund was long cloaked in secrecy, making the story of its rise . . . and its ultimate destruction that much more fascinating.”—The Washington Post “Story-telling journalism at its best.”—The Economist

Showing 8 of 28 similar books

Bill Ackman is an American hedge fund manager and founder of Pershing Square Capital Management, known for his activist investing style. Ackman has been involved in high-profile investment battles, including his campaigns against companies like Herbalife and his successful turnaround of companies like Canadian Pacific Railway. He is known for taking bold, contrarian positions and for his ability to influence corporate governance through shareholder activism. Ackman’s investing philosophy focuses on long-term value creation, and he has become one of the most recognized figures in the finance world.

Nathan Murphy is a celebrated author known for his compelling narratives and intricate character development. He gained widespread acclaim with his debut novel, "Echoes of Silence," which won the National Book Award for Fiction. Murphy's subsequent works, including "Whispers in the Wind" and "Shadows of Tomorrow," have further cemented his reputation as a master storyteller. His unique ability to blend historical contexts with contemporary issues has resonated with a diverse audience, earning him a dedicated readership. In addition to his novels, Murphy is an advocate for literacy and has contributed significantly to various educational programs aimed at promoting reading and writing skills among youth.

Charlie Munger is an American investor, businessman, and philanthropist, best known as the vice chairman of Berkshire Hathaway, where he partners with Warren Buffett. Renowned for his insights on investment strategies and mental models, Munger has significantly influenced the world of finance. His notable literary contributions include "Poor Charlie's Almanack," a compilation of his speeches and writings that distill his wisdom on decision-making and business principles. Munger's work emphasizes the importance of multidisciplinary thinking and continuous learning. Beyond his financial acumen, he is celebrated for his charitable efforts, particularly in education and healthcare.

Ray Dalio is the founder of Bridgewater Associates, one of the largest and most successful hedge funds in the world. He is also the author of the bestselling book Principles, where he outlines his philosophy on life, leadership, and investing. Ray is renowned for his unique approach to transparency, radical truth, and thoughtful disagreement within organizations. His insights into economics and investing have made him one of the most influential figures in the financial world. Dalio continues to be a thought leader in business, economics, and philanthropy.

Andrew Lokenauth is a distinguished author and financial expert known for his insightful contributions to personal finance and investment literature. With a career spanning over a decade, he has written extensively on topics such as wealth management, financial planning, and market analysis. Lokenauth's works are celebrated for their clarity and practical advice, making complex financial concepts accessible to a broad audience. He has been featured in numerous financial publications and has established himself as a trusted voice in the industry. Beyond his writing, Lokenauth is also a sought-after speaker, sharing his expertise at various seminars and workshops.

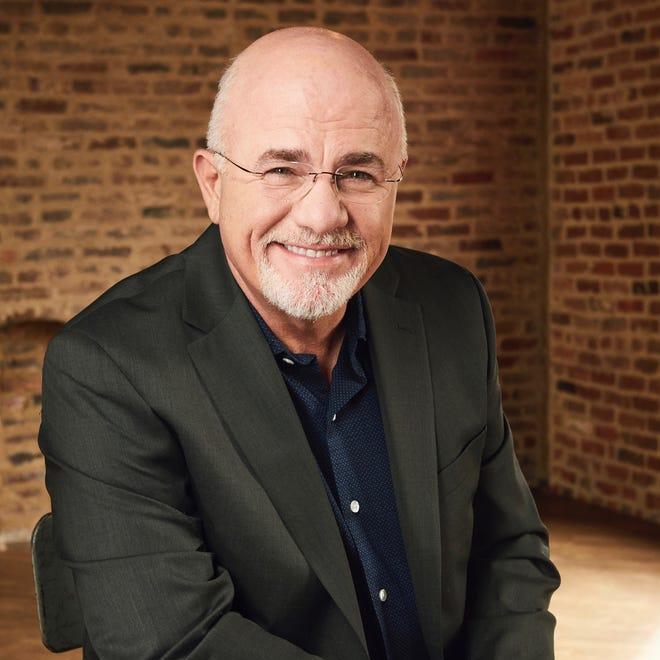

Dave Ramsey is a personal finance expert, radio host, and bestselling author known for his book The Total Money Makeover. He advocates for debt-free living and offers practical advice on budgeting, saving, and investing. Ramsey’s popular radio show, The Dave Ramsey Show, has reached millions of listeners, where he provides real-world financial advice and helps individuals achieve financial peace. His Baby Steps method for eliminating debt and building wealth has become a cornerstone of his teachings. Ramsey’s work has made him one of the most well-known financial educators in the U.S.

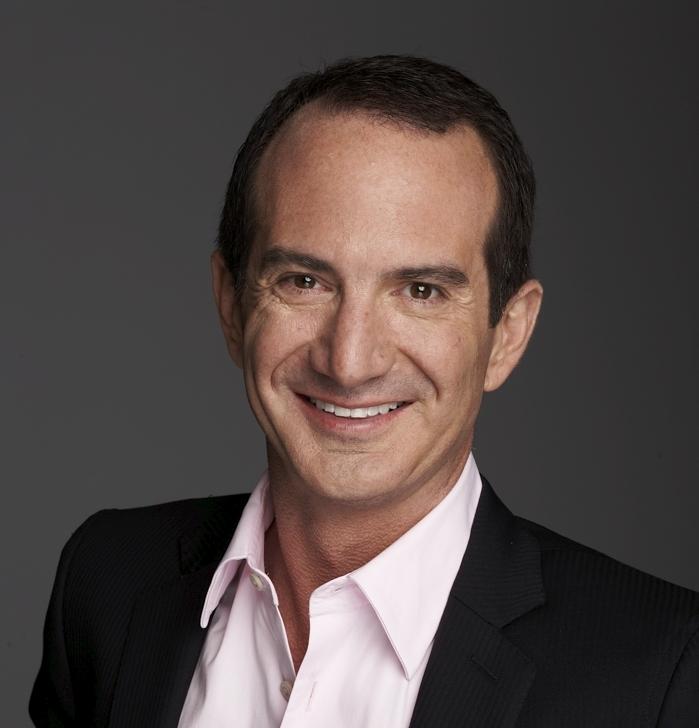

David Bach is a financial expert and bestselling author known for his Finish Rich book series, including The Automatic Millionaire. He has made a career out of teaching people how to build wealth through small, manageable financial habits like “paying yourself first” and automating savings. His approach to personal finance is accessible and focuses on helping everyday individuals achieve long-term financial security. David has appeared on numerous media platforms, advocating for financial literacy and encouraging people to take control of their financial futures.

Eric Jorgenson is an author, investor, and product strategist best known for his book The Almanack of Naval Ravikant, which distills the wisdom of the entrepreneur and angel investor Naval Ravikant. Jorgenson's work focuses on personal development, wealth creation, and life philosophy. His ability to synthesize complex ideas into actionable insights has made his writing widely popular among entrepreneurs and tech enthusiasts. Beyond writing, Jorgenson has worked in product strategy at Zaarly, a marketplace for home services, and is involved in early-stage startup investing. He frequently speaks on the intersection of business, technology, and philosophy, and his blog covers topics ranging from mental models to entrepreneurship. Jorgenson's approach emphasizes learning from others' experiences and applying timeless principles to modern challenges. He continues to inspire a generation of readers with his clear, thoughtful reflections on how to live a more successful and fulfilling life.

Showing 8 of 17 related collections

“When Genius Failed: The Rise and Fall of Long-Term Capital Management by Roger Lowenstein explores the complexities of finance and risk.”

When Genius Failed

By Roger Lowenstein

Discover a world of knowledge through our extensive collection of book summaries.

Roger Lowenstein is an acclaimed American financial journalist and author known for his insightful analysis of the stock market and investment strategies. He gained prominence with his best-selling books, including "When Genius Failed," which chronicles the rise and fall of Long-Term Capital Management, and "Buffett: The Making of an American Capitalist," a biography of famed investor Warren Buffett. Lowenstein has contributed to major publications such as The Wall Street Journal and The New York Times, showcasing his ability to distill complex financial concepts for a general audience. With a background in economics, he combines storytelling with rigorous research to illuminate the intricacies of financial markets. Through his writing, Lowenstein has not only informed readers but also shaped the discourse around investing and economic thought.

Key information about the book.

Support local bookstores: BookShop gives a portion of each sale to independent bookshops!

In J.R.R. Tolkien's epic saga, "The Lord of the Rings," an unsuspecting hobbit named Frodo Baggins embarks on a perilous quest to destroy a powerful ring that could plunge Middle-earth into darkness. As he journeys through treacherous lands and faces formidable foes, he is joined by a diverse fellowship of allies, each with their own secrets and strengths. Betrayals and sacrifices abound, testing their bonds and resolve as the shadow of evil looms ever closer. With breathtaking landscapes and profound themes of friendship, courage, and the struggle between good and evil, Tolkien crafts a rich tapestry that captivates the imagination. Will Frodo and his companions triumph against the dark forces, or will the allure of the ring claim them all?

In "Money: Master the Game," Tony Robbins unlocks the secrets to financial freedom through insights from legendary investors and his own transformative experiences. He presents a comprehensive blueprint that demystifies the world of finance, empowering readers to take control of their financial destinies. Packed with actionable strategies, Robbins reveals the psychological barriers that hold us back from wealth and how to overcome them. The book challenges conventional wisdom, urging readers to think differently about money and investing. Get ready to embark on an enlightening journey that could reshape your financial future forever!

In "The Psychology of Money," Morgan Housel unravels the complex relationship between our emotions and financial decisions. Through captivating anecdotes and profound insights, he reveals that wealth isn't just about numbers, but about behavior and mindset. The book challenges conventional wisdom, urging readers to understand the subtle psychological forces that influence our spending and saving habits. Housel's reflections highlight the power of patience, humility, and a long-term perspective in building true financial success. Prepare to rethink everything you thought you knew about money and its role in your life!

In "Fooled by Randomness," Nassim Nicholas Taleb explores the hidden influence of chance in our lives, challenging our perceptions of luck, skill, and success. He argues that many people attribute their achievements to talent rather than the randomness that often underpins them. Through a blend of personal anecdotes and sharp wit, Taleb reveals how cognitive biases distort our understanding of risk and probability. He reminds us that, in the grand theater of life, we are often unwitting actors in a play scripted by randomness. Prepare to rethink your beliefs about fortune and failure as you uncover the profound truths lurking beneath the surface of chance.

In 'I Will Teach You to Be Rich, Second Edition,' Ramit Sethi provides a no-nonsense guide to mastering personal finance with a blend of humor and practicality. He challenges conventional money advice and introduces readers to a unique banking system for maximizing their savings. Through straightforward strategies, Sethi reveals how to automate finances and invest wisely for the long term. Each chapter brims with actionable tips that encourage readers to take control of their financial futures. With insights that delve deep into psychology and behavior, this book is a game-changer for anyone seeking to build real wealth.

Liar's Poker takes you deep into the high-stakes world of Wall Street during the 1980s, where the line between truth and deception blurs in the cutthroat arena of finance. Author Michael Lewis pulls back the curtain on the chaotic life of bond traders, showcasing a ruthless culture driven by greed and bravado. Through vivid anecdotes and sharp insights, readers are thrust into the thrilling, sometimes absurd realm of investment banking. As Lewis navigates the intricacies of "big swinging d***s," he unveils the strategies and psychological games that define success in this high-pressure environment. Will you emerge with a new understanding of the financial world and its enigmatic players?

In "A Random Walk Down Wall Street," Burton Malkiel challenges the myth of market predictability and unveils the chaos underlying financial markets. Through engaging anecdotes and sharp insights, he demystifies complex investment strategies while advocating for the simplicity of index funds. Readers are taken on a journey through the history of financial theory and practical investing advice, revealing how randomness shapes market movements. Malkiel's compelling arguments will make you question conventional wisdom and reconsider your approach to investing. Are you ready to explore the unpredictable world of finance and learn how to navigate it wisely?

In "No Bad Kids: Toddler Discipline Without Shame," author Janet Lansbury challenges conventional discipline methods by advocating for a compassionate and respectful approach to toddler behavior. She encourages parents to see their toddlers as competent individuals worthy of understanding, rather than miscreants in need of punishment. With practical strategies rooted in empathy and connection, Lansbury empowers caregivers to foster a loving environment while setting clear boundaries. The book is filled with real-life scenarios that illuminate the complexities of parenting young children. Prepare to revolutionize your approach to discipline and nurture a deeper bond with your child!