Dive into the captivating fusion of physics and finance in 'The Statistical Mechanics of Financial Markets' by Johannes Voit. This innovative book explores how statistical mechanics can unveil the hidden dynamics of financial markets, illuminating their often chaotic behavior. Voit masterfully translates complex scientific concepts into insights that can redefine your understanding of market fluctuations. Discover how the principles of thermodynamics can be applied to market behavior, challenging conventional economic theories. Prepare to see finance through a revolutionary lens that bridges the gap between science and economic prediction!

By Johannes Voit

Published: 2005

"In the delicate dance of numbers and human emotion, the statistical mechanics of financial markets reveals the hidden patterns that govern our choices and shape our realities."

This highly praised introductory treatment describes the parallels between statistical physics and finance - both those established in the 100-year long interaction between these disciplines, as well as new research results on financial markets. The random-walk technique, well known in physics, is also the basic model in finance, upon which are built, for example, the Black-Scholes theory of option pricing and hedging, plus methods of portfolio optimization. Here the underlying assumptions are assessed critically. Using empirical financial data and analogies to physical models such as fluid flows, turbulence, or superdiffusion, the book develops a more accurate description of financial markets based on random walks. With this approach, novel methods for derivative pricing and risk management can be formulated. Computer simulations of interacting-agent models provide insight into the mechanisms underlying unconventional price dynamics. It is shown that stock exchange crashes can be modelled in ways analogous to phase transitions and earthquakes, and sometimes have even been predicted successfully. This third edition of The Statistical Mechanics of Financial Markets especially stands apart from other treatments because it offers new chapters containing a practitioner's treatment of two important current topics in banking: the basic notions and tools of risk management and capital requirements for financial institutions, including an overview of the new Basel II capital framework which may well set the risk management standards in scores of countries for years to come.

Showing 8 of 26 similar books

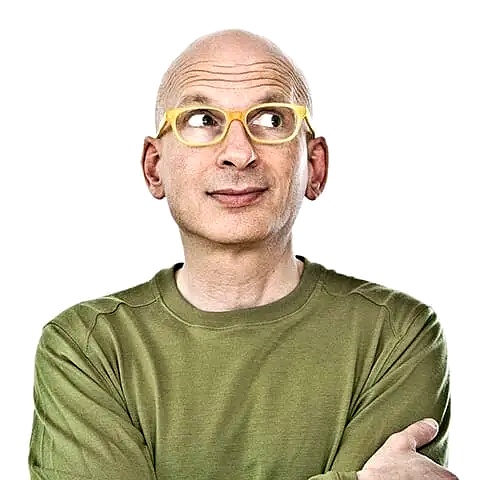

Seth Godin is a prolific author and entrepreneur, renowned for his influential contributions to marketing and business thought leadership. He has written over 20 bestselling books, including "Purple Cow," "Linchpin," and "The Dip," which have revolutionized modern marketing strategies and inspired countless professionals. Godin's work emphasizes the importance of creativity, innovation, and the power of ideas in building successful enterprises. He is also the founder of altMBA, an online leadership and management workshop, and he consistently shares his insights through his popular daily blog. Godin's impact on the marketing world has earned him a spot in the Direct Marketing Hall of Fame.

Sophie Bakalar is a distinguished author and venture capitalist known for her adept storytelling and insightful exploration of contemporary issues. Her debut novel received critical acclaim for its nuanced portrayal of complex characters and societal dynamics. In addition to her literary achievements, Bakalar is a co-founder of a successful venture firm, where she leverages her keen understanding of market trends and innovation. Her essays and articles, often featured in prominent publications, reflect her deep engagement with cultural and technological shifts. Bakalar's multifaceted career bridges the worlds of literature and entrepreneurship, making her a unique voice in both fields.

Barack Obama is the 44th President of the United States, serving from 2009 to 2017. As the first African American president, Obama’s leadership marked a historic moment in American history. His administration focused on healthcare reform, economic recovery from the Great Recession, and environmental policies. He is best known for the Affordable Care Act, as well as his efforts to expand civil rights and restore diplomatic relations with Cuba. Since leaving office, Obama has continued to engage in public life through his foundation, focusing on leadership development, civic engagement, and global issues.

Mark Manson is a best-selling author and personal development expert known for his candid and no-nonsense approach to self-help. His most notable work, "The Subtle Art of Not Giving a F*ck," has sold millions of copies worldwide and has been translated into numerous languages, resonating with readers for its practical advice and irreverent tone. Manson followed up with another successful book, "Everything Is F*cked: A Book About Hope," which further cemented his reputation as a thought leader in modern existentialism. In addition to his books, he runs a popular blog that delves into topics ranging from happiness to personal growth. His work has not only transformed the self-help genre but also influenced a global audience seeking authentic and actionable guidance.

Ana Lorena Fabrega is an innovative educator and author passionate about reimagining education. Known as “Ms. Fab,” she is the Chief Evangelist at Synthesis, an education startup inspired by the problem-solving and collaboration model used at SpaceX. She advocates for alternative learning methods, encouraging curiosity and creativity in students. Ana's work emphasizes the importance of engaging young learners in real-world challenges and critical thinking. She also shares insights on education reform through her popular newsletter, Fab Fridays.

Charlie Munger is an American investor, businessman, and philanthropist, best known as the vice chairman of Berkshire Hathaway, where he partners with Warren Buffett. Renowned for his insights on investment strategies and mental models, Munger has significantly influenced the world of finance. His notable literary contributions include "Poor Charlie's Almanack," a compilation of his speeches and writings that distill his wisdom on decision-making and business principles. Munger's work emphasizes the importance of multidisciplinary thinking and continuous learning. Beyond his financial acumen, he is celebrated for his charitable efforts, particularly in education and healthcare.

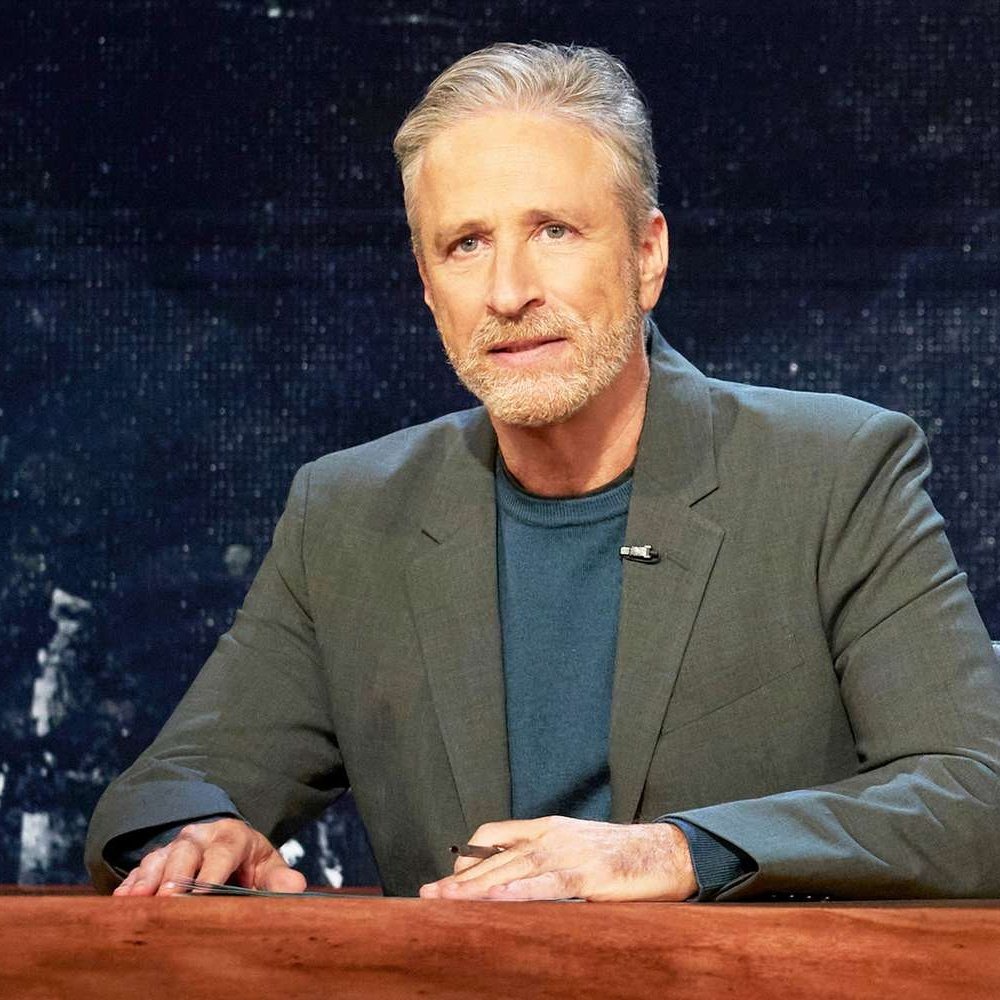

Jon Stewart is an American comedian, writer, and former host of The Daily Show, where he gained fame for his satirical take on news and politics. Stewart transformed The Daily Show into a critical voice in American media, blending humor with hard-hitting commentary on political and social issues. After stepping down from the show, Stewart has continued to advocate for causes like 9/11 first responders and veterans' rights. He is also a filmmaker, directing the political satire film Irresistible. Stewart remains a significant figure in American culture, known for his wit, activism, and influence on political discourse.

Vlad Tenev is a Bulgarian-American entrepreneur best known for co-founding Robinhood, a revolutionary commission-free stock trading platform that has democratized investing for millions. While Tenev is not traditionally known for contributions to literature, his impact on the financial industry has been widely covered in numerous business and technology publications. His leadership in fintech has inspired many discussions and analyses in books and articles focusing on modern financial innovation and the democratization of finance. Tenev's work has been pivotal in challenging traditional brokerage models, making him a significant figure in the narrative of financial technology. His story and achievements are frequently cited in discussions about the future of investing and the role of technology in financial services.

Showing 8 of 12 related collections

“In the delicate dance of numbers and human emotion, the statistical mechanics of financial markets reveals the hidden patterns that govern our choices and shape our realities.”

The Statistical Mechanics of Financial Markets

By Johannes Voit

Discover a world of knowledge through our extensive collection of book summaries.

Johannes Voit is a distinguished author known for his thought-provoking novels and essays that explore the complexities of human relationships and existential themes. His notable works include "The Echo of Silence," a poignant exploration of isolation in modern society, and "Fragments of Time," a narrative that weaves together past and present to unveil the intricacies of memory. Voit’s writing style is characterized by lyrical prose and deep psychological insight, inviting readers to reflect on their own experiences while immersing them in richly crafted worlds.

Key information about the book.

Support local bookstores: BookShop gives a portion of each sale to independent bookshops!

In "The Big Short," Michael Lewis unveils the hidden complexities of the 2008 financial crisis through the eyes of a few unconventional investors who saw disaster coming. As they bet against the housing market, these outsiders navigate Wall Street’s labyrinthine greed and negligence, exposing the flawed logic behind the crisis. With wit and suspense, Lewis reveals the shocking truth about the financial instruments that led to economic chaos. Readers will find themselves questioning the very foundations of finance while gripping the edge of their seats at the unfolding drama. Can a handful of mavericks really challenge the system, or are they just playing a dangerous game of chance?

In "Black Edge," investigative journalist Sheelah Kolhatkar delves into the high-stakes world of hedge funds and the enigmatic figure of Steven A. Cohen. As she unravels the saga of insider trading, greed, and Wall Street's murky ethics, the book pulls readers into a gripping tale of ambition that spans decades. With intellectual prowess and audacious risk-taking, Cohen's rise to power raises questions about the moral compass of finance. Kolhatkar's penetrating analysis unveils the dark side of wealth and the relentless pursuit of success, leaving readers questioning the true cost of ambition. Will you dare to uncover the secrets of a financial titan and the shadowy underworld they inhabit?

In 'Fiasco,' Frank Partnoy unveils the chaotic world of financial markets, where seemingly sound decisions can lead to catastrophic failures. He provides a gripping narrative of the 2008 financial crisis, dissecting the miscalculations and greed that fueled it. Through engaging anecdotes and sharp insights, Partnoy challenges readers to rethink risk and the nature of financial systems. This exploration serves as both a cautionary tale and a deep dive into the mechanisms that govern our economy. Prepare to question everything you thought you knew about finance and the true cost of ambition.

In 'The Physics of Wall Street', James Owen Weatherall explores the intriguing intersection between finance and physics, revealing how mathematical theories and models shape our understanding of financial markets. The book uncovers the pivotal roles that concepts like chaos theory and probability play in the quest for market predictions. Weatherall challenges the traditional views of finance, asking whether the certainty that physicists rely on is ever achievable in the unpredictable world of stocks and trades. With captivating anecdotes and insights from both disciplines, readers are drawn into a narrative that is equal parts informative and thought-provoking. Are markets truly a dance of deterministic patterns, or are they forever shrouded in uncertainty?

'Wooden Leg' is a powerful memoir from the perspective of a Native American who shares the harrowing yet inspiring tale of his experiences during the tumultuous era of westward expansion. With vivid storytelling, the author recounts his resilience and the cultural clash that defined his childhood. This poignant narrative delves into themes of identity, survival, and the struggle against oppression. Will you discover the secrets of strength and wisdom that emerge from his extraordinary journey? Join Wooden Leg as he reclaims his history and offers a unique lens on America’s past.

In 'The Making of Europe,' Robert Bartlett explores the intricate tapestry of cultural, social, and political transformations that shaped the European continent from the fall of the Roman Empire to the dawn of the modern age. He weaves together narratives of migration, conflict, and cooperation among diverse peoples, revealing how ideas and identities evolved over centuries. Through compelling anecdotes and rich historical analysis, Bartlett challenges conventional ideas about European unity and diversity. The book invites readers to reconsider the historical forces that continue to influence Europe today. Prepare to embark on a journey that uncovers the complexities of a continent redefined by its past.

In 'Profit First', Mike Michalowicz challenges the traditional accounting formula of 'Sales - Expenses = Profit' and flips it on its head. He introduces a revolutionary approach where businesses prioritize profit by allocating funds first, ensuring that financial health comes before expenses. This simple yet powerful system empowers entrepreneurs to regain control over their finances, eliminate unnecessary spending, and cultivate a profitable mindset. Through practical strategies and real-life examples, Michalowicz illustrates how anyone can transform their business into a money-making machine. Are you ready to discover the secret to lasting profitability?