A Short History of Financial Euphoria Book Summary

In 'A Short History of Financial Euphoria', John Kenneth Galbraith uncovers the cyclical nature of financial bubbles throughout history, revealing the patterns of human behavior that lead to economic crises. With wit and insight, he illustrates how greed and irrationality have historically blindsided the masses, prompting investment frenzies that often end in disaster. Galbraith's reflections serve as a cautionary tale, urging readers to recognize the signs of impending euphoria before it's too late. This brief yet impactful read challenges our understanding of finance and the psychology behind it. Are we destined to repeat the mistakes of the past, or can we finally learn from them?

By John Kenneth Galbraith

Published: 1994

"The history of finance is a history of man’s tendency to forget the lessons of the past and to repeat the same mistakes, only on a grander scale."

Book Review of A Short History of Financial Euphoria

The world-renowned economist offers "dourly irreverent analyses of financial debacle from the tulip craze of the seventeenth century to the recent plague of junk bonds." —The Atlantic. With incomparable wisdom, skill, and wit, world-renowned economist John Kenneth Galbraith traces the history of the major speculative episodes in our economy over the last three centuries. Exposing the ways in which normally sane people display reckless behavior in pursuit of profit, Galbraith asserts that our "notoriously short" financial memory is what creates the conditions for market collapse. By recognizing these signs and understanding what causes them we can guard against future recessions and have a better hold on our country's (and our own) financial destiny.

Book Overview of A Short History of Financial Euphoria

About the Book Author

John Kenneth Galbraith

John Kenneth Galbraith (1908-2006) was a prominent American economist, public official, and author, best known for his contributions to economic theory and policy in the 20th century. A leading figure in the post-World War II era, Galbraith's work often focused on the interplay between economics and societal values. His notable works include 'The Affluent Society,' 'The New Industrial State,' and 'The Economics of Innocent Fraud.' Galbraith's writing style is characterized by his ability to simplify complex economic concepts while also merging wit, satire, and a strong sense of social critique, making his insights accessible to a broad audience.

Book Details

Key information about the book.

- Authors

- John Kenneth Galbraith

- Published

- July 1994

- Publisher

- Penguin

- ISBN

- 0140238565

- Language

- English

- Pages

- 130

- Genres

- FinanceBusiness and EconomicsEconomic PolicyBehavioral Finance

Purchase Options

Support local bookstores: BookShop gives a portion of each sale to independent bookshops!

Similar books you might like →

MONEY Master the Game Book Summary

In "Money: Master the Game," Tony Robbins unlocks the secrets to financial freedom through insights from legendary investors and his own transformative experiences. He presents a comprehensive blueprint that demystifies the world of finance, empowering readers to take control of their financial destinies. Packed with actionable strategies, Robbins reveals the psychological barriers that hold us back from wealth and how to overcome them. The book challenges conventional wisdom, urging readers to think differently about money and investing. Get ready to embark on an enlightening journey that could reshape your financial future forever!

Save More Tomorrow Book Summary

In "Save More Tomorrow," behavioral finance pioneer Richard H. Thaler unveils a revolutionary approach to personal savings that empowers individuals to take control of their financial futures. By integrating the principles of human psychology with smart financial strategies, Thaler proposes a system where employees can commit to saving a portion of their future raises, making saving effortless and automatic. This innovative method not only combats the common barriers to saving but also transforms lifestyles and retirement outcomes. Through captivating anecdotes and research, Thaler illustrates how small behavioral tweaks can lead to monumental financial gains. Dive into this compelling narrative and discover how you can effortlessly boost your savings and secure a more prosperous future!

Nudge Book Summary

In "Nudge," behavioral economists Richard Thaler and Cass Sunstein unveil the subtle art of influencing choices and shaping outcomes without restricting freedom. They explore how small, seemingly insignificant changes in the way options are presented can lead to drastically improved decisions in health, finance, and overall happiness. With compelling real-world examples and engaging insights, the authors demonstrate how understanding human psychology can empower individuals and policymakers alike. Dive into a world where choice architecture transforms lives and reshapes society's approach to welfare. Discover the hidden nudges that could change everything about the way we choose!

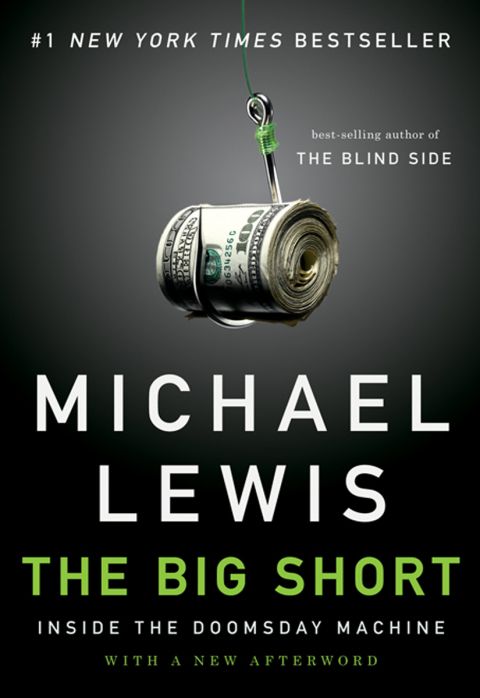

The Big Short: Inside the Doomsday Machine Book Summary

In "The Big Short," Michael Lewis unveils the hidden complexities of the 2008 financial crisis through the eyes of a few unconventional investors who saw disaster coming. As they bet against the housing market, these outsiders navigate Wall Street’s labyrinthine greed and negligence, exposing the flawed logic behind the crisis. With wit and suspense, Lewis reveals the shocking truth about the financial instruments that led to economic chaos. Readers will find themselves questioning the very foundations of finance while gripping the edge of their seats at the unfolding drama. Can a handful of mavericks really challenge the system, or are they just playing a dangerous game of chance?

Liar's Poker Book Summary

Liar's Poker takes you deep into the high-stakes world of Wall Street during the 1980s, where the line between truth and deception blurs in the cutthroat arena of finance. Author Michael Lewis pulls back the curtain on the chaotic life of bond traders, showcasing a ruthless culture driven by greed and bravado. Through vivid anecdotes and sharp insights, readers are thrust into the thrilling, sometimes absurd realm of investment banking. As Lewis navigates the intricacies of "big swinging d***s," he unveils the strategies and psychological games that define success in this high-pressure environment. Will you emerge with a new understanding of the financial world and its enigmatic players?

Black Edge Book Summary

In "Black Edge," investigative journalist Sheelah Kolhatkar delves into the high-stakes world of hedge funds and the enigmatic figure of Steven A. Cohen. As she unravels the saga of insider trading, greed, and Wall Street's murky ethics, the book pulls readers into a gripping tale of ambition that spans decades. With intellectual prowess and audacious risk-taking, Cohen's rise to power raises questions about the moral compass of finance. Kolhatkar's penetrating analysis unveils the dark side of wealth and the relentless pursuit of success, leaving readers questioning the true cost of ambition. Will you dare to uncover the secrets of a financial titan and the shadowy underworld they inhabit?

The Essays of Warren Buffett Book Summary

In "The Essays of Warren Buffett," the legendary investor distills decades of wisdom into a compelling collection of insights on investing, business, and life. Through a series of thought-provoking essays, Buffett shares his unique perspective on risk, value, and the importance of patience in the tumultuous world of finance. His distinctive voice combines humor with profound lessons, making complex concepts accessible to both novice investors and seasoned pros. As you delve into his reflections, you'll uncover the principles that have guided his success and how they can be applied to your own financial journey. Prepare to be inspired and challenged to rethink your approach to investing and wealth-building!

A Random Walk Down Wall Street: The Time-Tested Strategy for Successful Investing (Ninth Edition) Book Summary

In "A Random Walk Down Wall Street," Burton Malkiel challenges the myth of market predictability and unveils the chaos underlying financial markets. Through engaging anecdotes and sharp insights, he demystifies complex investment strategies while advocating for the simplicity of index funds. Readers are taken on a journey through the history of financial theory and practical investing advice, revealing how randomness shapes market movements. Malkiel's compelling arguments will make you question conventional wisdom and reconsider your approach to investing. Are you ready to explore the unpredictable world of finance and learn how to navigate it wisely?

Showing 8 of 30 similar books

Similar Book Recommendations →

David Heinemeier Hansson's Book Recommendations

David Heinemeier Hansson, also known as DHH, is a Danish programmer, entrepreneur, and author, best known as the creator of Ruby on Rails, a popular web application framework. Heinemeier Hansson is also a partner at Basecamp, a project management and collaboration software company he co-founded. His contributions to software development have earned him widespread recognition, with Ruby on Rails being used by thousands of developers and companies worldwide. Heinemeier Hansson is also a vocal advocate for remote work, simplicity in business, and sustainable work practices, ideas he explores in his bestselling books Rework and It Doesn’t Have to Be Crazy at Work. In addition to his work in tech, he is an accomplished race car driver, having competed in the 24 Hours of Le Mans. Heinemeier Hansson’s approach to work-life balance and entrepreneurship has made him a thought leader in the tech community, where he continues to challenge traditional business practices and advocate for more human-centered approaches to work

Alexis Ohanian's Book Recommendations

Alexis Ohanian is an American entrepreneur, investor, and co-founder of Reddit, one of the world’s most popular social news and discussion platforms. Ohanian is also a prominent advocate for open internet and net neutrality, and he has invested in numerous startups through his venture capital firm, Initialized Capital. In addition to his work in tech, Ohanian is involved in philanthropy, supporting causes related to women’s rights, education, and social justice. He is married to tennis star Serena Williams, and together they advocate for gender equality and inclusive leadership. Ohanian’s influence in the tech world and his commitment to social impact have made him a respected figure in both business and activism.

Charlie Munger's Book Recommendations

Charlie Munger is an American investor, businessman, and philanthropist, best known as the vice chairman of Berkshire Hathaway, where he partners with Warren Buffett. Renowned for his insights on investment strategies and mental models, Munger has significantly influenced the world of finance. His notable literary contributions include "Poor Charlie's Almanack," a compilation of his speeches and writings that distill his wisdom on decision-making and business principles. Munger's work emphasizes the importance of multidisciplinary thinking and continuous learning. Beyond his financial acumen, he is celebrated for his charitable efforts, particularly in education and healthcare.

Ana Fabrega's Book Recommendations

Ana Lorena Fabrega is an innovative educator and author passionate about reimagining education. Known as “Ms. Fab,” she is the Chief Evangelist at Synthesis, an education startup inspired by the problem-solving and collaboration model used at SpaceX. She advocates for alternative learning methods, encouraging curiosity and creativity in students. Ana's work emphasizes the importance of engaging young learners in real-world challenges and critical thinking. She also shares insights on education reform through her popular newsletter, Fab Fridays.

Eric Weinstein's Book Recommendations

Eric Weinstein is an accomplished American mathematician, economist, and writer, known for his influential work in the fields of geometric unity and economic theory. As the Managing Director of Thiel Capital, he has significantly impacted the financial and technological sectors. Weinstein is also renowned for his thought-provoking discussions on the podcast "The Portal," where he explores complex scientific and social issues. He has written extensively on a variety of topics, contributing to both academic and popular literature. His unique perspectives and interdisciplinary approach have earned him recognition as a leading intellectual voice of his generation.

Bill Gates's Book Recommendations

Bill Gates, co-founder of Microsoft Corporation, is a pioneering figure in the tech industry, having played a key role in the personal computer revolution. His work at Microsoft, particularly the development of Windows, transformed software and computing globally. Beyond his technology contributions, Gates is also a prolific author, with notable works such as "The Road Ahead" and "Business @ the Speed of Thought," which offer insights into the future of technology and business. Additionally, his philanthropic efforts through the Bill & Melinda Gates Foundation have had a profound impact on global health, education, and poverty. Gates continues to influence both technology and literature with his forward-thinking perspectives and innovative ideas.

“The history of finance is a history of man’s tendency to forget the lessons of the past and to repeat the same mistakes, only on a grander scale.”

A Short History of Financial Euphoria

By John Kenneth Galbraith

Frequently Asked Questions

Explore Our Catalogue

Discover a world of knowledge through our extensive collection of book summaries.

Genres

Genres

Genres

Featured Collections

- Top Book Club Picks

- One-Stop Nutrition

- Summer Reads 2024

- Best Beach Reads 2024

- Work-Life Balance Guide

- Time Management

- Healthy Foods

- Entrepreneur Toolkit

- Mind & Body Wellness

- Future Tech Insights

- Leadership Essentials

- Financial Freedom

- Sci-Fi Masterpieces

- Parenting 101

- Books That Became Blockbusters

- Guide to a Healthy Pregnancy