In "The Essays of Warren Buffett," the legendary investor distills decades of wisdom into a compelling collection of insights on investing, business, and life. Through a series of thought-provoking essays, Buffett shares his unique perspective on risk, value, and the importance of patience in the tumultuous world of finance. His distinctive voice combines humor with profound lessons, making complex concepts accessible to both novice investors and seasoned pros. As you delve into his reflections, you'll uncover the principles that have guided his success and how they can be applied to your own financial journey. Prepare to be inspired and challenged to rethink your approach to investing and wealth-building!

By Lawrence A. Cunningham, Warren E. Buffett

Published: 2013

"Risk arises from not knowing what you’re doing."

In the third edition of this international best seller, Lawrence Cunningham brings you the latest wisdom from Warren Buffett’s annual letters to Berkshire Hathaway shareholders. New material addresses: the financial crisis and its continuing implications for investors, managers and society; the housing bubble at the bottom of that crisis; the debt and derivatives excesses that fueled the crisis and how to deal with them; controlling risk and protecting reputation in corporate governance; Berkshire’s acquisition and operation of Burlington Northern Santa Fe; the role of oversight in heavily regulated industries; investment possibilities today; and weaknesses of popular option valuation models. Some other material has been rearranged to deepen the themes and lessons that the collection has always produced: Buffett’s “owner-related business principles” are in the prologue as a separate subject and valuation and accounting topics are spread over four instead of two sections and reordered to sharpen their payoff. Media coverage is available at the following links: Interviews/Podcasts: Motley Fool, click here. Money, Riches and Wealth, click here. Manual of Ideas, click here. Corporate Counsel, click here. Reviews: William J. Taylor, ABA Banking Journal, click here. Bob Morris, Blogging on Business, click here. Pamela Holmes, Saturday Evening Post, click here. Kevin M. LaCroix, D&O Diary, click here. Blog Posts: On Finance issues (Columbia University), click here. On Berkshire post-Buffett (Manual of Ideas), click here. On Publishing the book (Value Walk), click here. On Governance issues (Harvard University blog), click here. Featured Stories/Recommended Reading: Motley Fool, click here. Stock Market Blog, click here. Motley Fool Interviews with LAC at Berkshire's 2013 Annual Meeting Berkshire Businesses: Vastly Different, Same DNA, click here. Is Berkshire's Fat Wallet an Enemy to Its Success?, click here. Post-Buffett Berkshire: Same Question, Same Answer, click here. How a Disciplined Value Approach Works Across the Decades, click here. Through the Years: Constant Themes in Buffett's Letters, click here. Buffett's Single Greatest Accomplishment, click here. Where Buffett Is Finding Moats These Days, click here. How Buffett Has Changed Through the Years, click here. Speculating on Buffett's Next Acquisition, click here. Buffett Says “Chief Risk Officers” Are a Terrible Mistake, click here. Berkshire Without Buffett, click here.

Showing 8 of 26 similar books

David Heinemeier Hansson, also known as DHH, is a Danish programmer, entrepreneur, and author, best known as the creator of Ruby on Rails, a popular web application framework. Heinemeier Hansson is also a partner at Basecamp, a project management and collaboration software company he co-founded. His contributions to software development have earned him widespread recognition, with Ruby on Rails being used by thousands of developers and companies worldwide. Heinemeier Hansson is also a vocal advocate for remote work, simplicity in business, and sustainable work practices, ideas he explores in his bestselling books Rework and It Doesn’t Have to Be Crazy at Work. In addition to his work in tech, he is an accomplished race car driver, having competed in the 24 Hours of Le Mans. Heinemeier Hansson’s approach to work-life balance and entrepreneurship has made him a thought leader in the tech community, where he continues to challenge traditional business practices and advocate for more human-centered approaches to work

Naval Ravikant is an entrepreneur, angel investor, and philosopher, best known as the co-founder of AngelList, a platform that connects startups with investors. Ravikant is a prolific thinker and writer on topics such as startups, investing, and personal well-being, sharing his wisdom through essays, podcasts, and social media. He has invested in over 100 companies, including Uber, Twitter, and Yammer, making him one of Silicon Valley’s most successful angel investors. Ravikant is also known for his philosophical musings on wealth, happiness, and the meaning of life, which have garnered him a large and dedicated following.

Charlie Munger is an American investor, businessman, and philanthropist, best known as the vice chairman of Berkshire Hathaway, where he partners with Warren Buffett. Renowned for his insights on investment strategies and mental models, Munger has significantly influenced the world of finance. His notable literary contributions include "Poor Charlie's Almanack," a compilation of his speeches and writings that distill his wisdom on decision-making and business principles. Munger's work emphasizes the importance of multidisciplinary thinking and continuous learning. Beyond his financial acumen, he is celebrated for his charitable efforts, particularly in education and healthcare.

Ray Dalio is the founder of Bridgewater Associates, one of the largest and most successful hedge funds in the world. He is also the author of the bestselling book Principles, where he outlines his philosophy on life, leadership, and investing. Ray is renowned for his unique approach to transparency, radical truth, and thoughtful disagreement within organizations. His insights into economics and investing have made him one of the most influential figures in the financial world. Dalio continues to be a thought leader in business, economics, and philanthropy.

Andrew Lokenauth is a distinguished author and financial expert known for his insightful contributions to personal finance and investment literature. With a career spanning over a decade, he has written extensively on topics such as wealth management, financial planning, and market analysis. Lokenauth's works are celebrated for their clarity and practical advice, making complex financial concepts accessible to a broad audience. He has been featured in numerous financial publications and has established himself as a trusted voice in the industry. Beyond his writing, Lokenauth is also a sought-after speaker, sharing his expertise at various seminars and workshops.

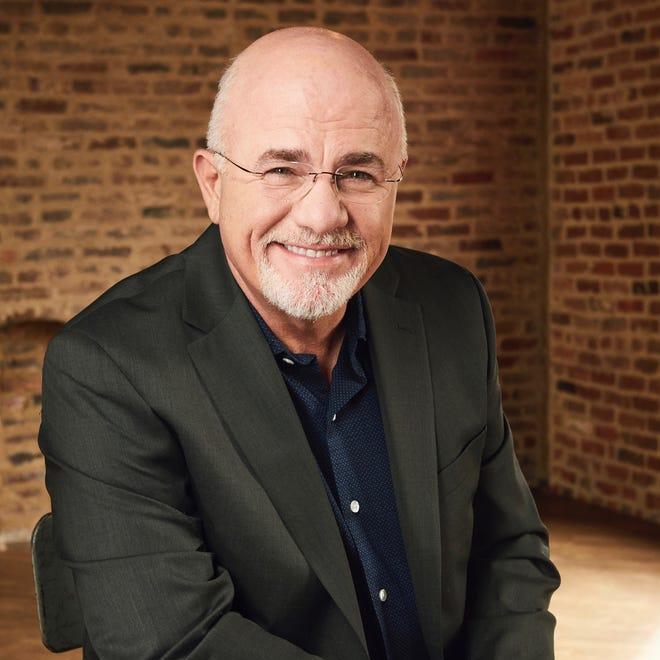

Dave Ramsey is a personal finance expert, radio host, and bestselling author known for his book The Total Money Makeover. He advocates for debt-free living and offers practical advice on budgeting, saving, and investing. Ramsey’s popular radio show, The Dave Ramsey Show, has reached millions of listeners, where he provides real-world financial advice and helps individuals achieve financial peace. His Baby Steps method for eliminating debt and building wealth has become a cornerstone of his teachings. Ramsey’s work has made him one of the most well-known financial educators in the U.S.

David Bach is a financial expert and bestselling author known for his Finish Rich book series, including The Automatic Millionaire. He has made a career out of teaching people how to build wealth through small, manageable financial habits like “paying yourself first” and automating savings. His approach to personal finance is accessible and focuses on helping everyday individuals achieve long-term financial security. David has appeared on numerous media platforms, advocating for financial literacy and encouraging people to take control of their financial futures.

Jason Zweig is a renowned financial journalist and author, best known for his insightful writings on personal finance and investing. He has been a long-time columnist for The Wall Street Journal, where his "The Intelligent Investor" column has garnered a wide readership. Zweig is also the author of several influential books, including "Your Money and Your Brain," which explores the neuroscience behind financial decision-making. He played a pivotal role in updating and annotating Benjamin Graham's classic, "The Intelligent Investor," making it accessible to modern readers. His work has significantly contributed to the public's understanding of behavioral finance and prudent investment strategies.

Showing 8 of 22 related collections

“Risk arises from not knowing what you’re doing.”

The Essays of Warren Buffett

By Lawrence A. Cunningham, Warren E. Buffett

Discover a world of knowledge through our extensive collection of book summaries.

Lawrence A. Cunningham is an acclaimed author and professor known for his expertise in finance, investment, and the intersection of literature and business. He is the author of several notable works, including "The Essays of Warren Buffett: Lessons for Corporate America," which has garnered widespread recognition for its insightful compilation of Buffett's thoughts on investing and corporate governance. Cunningham is also the author of "Value: The Four Cornerstones of Corporate Finance" and "The Intelligent Investor: A Guide to Value Investing," which reflects his commitment to making complex financial concepts accessible to a broader audience.

Cunningham’s writing style is characterized by clarity and pragmatism, blending analytical rigor with engaging narratives that appeal to both seasoned investors and novices alike. As a professor at George Washington University Law School and a sought-after speaker, he continues to influence the fields of finance and business through his compelling writing and teaching. His work not only educates but also inspires readers to think critically about investment strategies and corporate ethics in the modern economy.

Warren E. Buffett is a distinguished American investor, business tycoon, and philanthropist, widely regarded as one of the most successful investors in history. Born on August 30, 1930, in Omaha, Nebraska, Buffett is the chairman and CEO of Berkshire Hathaway, a multinational conglomerate holding company. He is known for his value investing philosophy, which emphasizes long-term investments in undervalued companies with strong fundamentals.

Buffett's notable works include his annual letters to Berkshire Hathaway shareholders, which have become essential reading for investors and provide insights into his investment strategies and economic outlook. These letters are characterized by their clarity, wit, and profound insights into market behavior and corporate governance. Additionally, his co-authored book, The Intelligent Investor (with Benjamin Graham), remains a classic in investment literature, promoting the principles of value investing.

With a writing style that is both accessible and engaging, Buffett speaks directly to his audience, breaking down complex financial concepts into understandable terms, making him a respected figure not just in finance but also in the realm of literature related to business and investing. His ability to distill wisdom from decades of market experience continues to inspire investors worldwide.

Key information about the book.

Support local bookstores: BookShop gives a portion of each sale to independent bookshops!

In "The Wealthy Gardener," author John Soforic reveals the transformative journey of a father teaching his son the intricate balance between wealth and wisdom. Through a series of poignant parables, readers explore the seeds of financial success that sprout from patience, dedication, and the right mindset. The book intertwines personal anecdotes with practical advice, challenging conventional notions of prosperity and fulfillment. As the characters navigate the gardens of their lives, they uncover profound truths about happiness, legacy, and the true meaning of wealth. Prepare to dig deep into a narrative that cultivates both inspiration and actionable insights for your own growth.

In "The Alchemist," Paulo Coelho weaves a mesmerizing tale of Santiago, a young shepherd who dreams of discovering his personal legend. Driven by an insatiable quest for treasure, he embarks on a transformative journey across deserts and cultures, encountering wise mentors and mystical omens along the way. Each encounter unveils profound truths about destiny, love, and the interconnectedness of all things. As Santiago wrestles with fears and realizations, readers are invited to reflect on their own paths and the dreams they hold dear. Will he find the treasure he seeks, or will the journey itself become the ultimate reward?

In "The Real Book of Real Estate," author Robert Kiyosaki unearths the hidden gems of wealth-building through property investment. With candid insights drawn from his own experiences, he dismantles common myths and reveals the strategies that can lead to financial freedom. This book isn’t just about numbers; it’s a masterclass in mindset, emphasizing the importance of surrounding yourself with the right team and resources. Kiyosaki’s engaging anecdotes and practical tips will inspire both novices and seasoned investors to reassess their approach to real estate. Prepare to unlock the secrets that could transform your financial future and discover the potential of becoming a savvy property mogul!

In "Save More Tomorrow," behavioral finance pioneer Richard H. Thaler unveils a revolutionary approach to personal savings that empowers individuals to take control of their financial futures. By integrating the principles of human psychology with smart financial strategies, Thaler proposes a system where employees can commit to saving a portion of their future raises, making saving effortless and automatic. This innovative method not only combats the common barriers to saving but also transforms lifestyles and retirement outcomes. Through captivating anecdotes and research, Thaler illustrates how small behavioral tweaks can lead to monumental financial gains. Dive into this compelling narrative and discover how you can effortlessly boost your savings and secure a more prosperous future!

In "Financial Peace Revisited," renowned financial guru Dave Ramsey lays out a transformative blueprint for achieving financial independence and peace of mind. Through compelling personal anecdotes and straightforward principles, he demystifies budgeting and debt management, empowering readers to take control of their finances. Ramsey's seven-step plan not only promises to eliminate debt but also encourages a mindset shift towards saving and giving. With a blend of practical advice and motivational insights, he confronts common financial fears and inspires readers to envision a life free from money stress. Dive into this engaging guide and discover the keys to unlocking your financial freedom!

In 'I Will Teach You to Be Rich, Second Edition,' Ramit Sethi provides a no-nonsense guide to mastering personal finance with a blend of humor and practicality. He challenges conventional money advice and introduces readers to a unique banking system for maximizing their savings. Through straightforward strategies, Sethi reveals how to automate finances and invest wisely for the long term. Each chapter brims with actionable tips that encourage readers to take control of their financial futures. With insights that delve deep into psychology and behavior, this book is a game-changer for anyone seeking to build real wealth.

In "Den of Thieves," journalist James B. Stewart pulls back the curtain on the high-stakes world of corporate America during the 1980s. This riveting narrative chronicles the lives of power brokers and insider traders who bent the rules to accumulate unimaginable wealth. As greed intertwines with ambition, a thrilling tale of deception unfolds, leading to dramatic investigations and shocking convictions. Stewart masterfully blends real-life drama with insights into the financial markets, leaving readers on the edge of their seats. Dive into the labyrinth of moral ambiguity and see how far the quest for success can lead one astray!

Security Analysis, authored by Benjamin Graham and David Dodd, unveils the art of valuing investments through a detailed lens of fundamental analysis. This classic masterpiece promotes the philosophy of value investing, encouraging readers to dive deep into financial statements rather than relying on market trends. With timeless principles and practical frameworks, it teaches how to uncover hidden gems in the stock market. As markets fluctuate, the authors remind us that understanding intrinsic value can lead to exceptional financial decisions. Are you ready to transform your investment strategies and unlock the secrets of successful investing?