The Most Important Thing Book Summary

In 'The Most Important Thing', renowned investor Howard Marks shares his insights on the philosophy of investing and the art of risk management. He emphasizes the importance of understanding market cycles and the psychology behind investment decisions. Through anecdotes and analysis, Marks reveals the critical elements that separate successful investors from the rest. Readers will discover the power of value investing and the need for a disciplined approach in uncertain times. This book is not just a guide for investors, but a thought-provoking exploration of how to think about risk and opportunity in any financial endeavor.

By Howard Marks

Published: 2011

"The most important thing is not how much you know, but how well you can apply that knowledge in the real world."

Book Review of The Most Important Thing

This book explains the keys to successful investment and the pitfalls that can destroy capital or ruin a career. Utilizing passages from his memos to illustrate his ideas, Marks teaches by example, detailing the development of an investment philosophy that fully acknowledges the complexities of investing and the perils of the financial world. Brilliantly applying insight to today's volatile markets, Marks offers a volume that is part memoir, part creed, with a number of broad takeaways.

Book Overview of The Most Important Thing

About the Book Author

Howard Marks

Howard Marks was a renowned writer and investor, best known for his impactful works in finance and memoirs that reflect his life experiences. His notable books include "The Most Important Thing: Uncommon Sense for the Thoughtful Investor," where he shares his insights on investment philosophy and market behavior. Marks is celebrated for his clear, engaging writing style that resonates with both novice and experienced investors. He combines profound market wisdom with personal anecdotes, making complex financial concepts accessible to a broader audience. His candid reflections on risk and opportunity have earned him a respected place in the financial literature realm.

Book Details

Key information about the book.

- Authors

- Howard Marks

- Published

- January 2011

- Publisher

- Columbia Business School Publishing

- ISBN

- 0231153686

- Language

- English

- Pages

- 180

- Genres

- InvestingFinanceBehavioral Finance

Purchase Options

Support local bookstores: BookShop gives a portion of each sale to independent bookshops!

Similar books you might like →

The Intelligent Investor Book Summary

In "The Intelligent Investor," Benjamin Graham unveils timeless strategies for navigating the volatile world of investing with wisdom and discipline. He introduces the concept of value investing, teaching readers to distinguish between price and intrinsic value, all while emphasizing the importance of a defensive investment strategy. Graham’s insightful principles empower investors to cultivate emotional resilience, protecting them from the relentless whims of the market. With real-world anecdotes and practical advice, this classic remains a cornerstone for anyone seeking financial success and peace of mind. Dive in to discover how patience, rationality, and a solid plan can transform your investment journey!

MONEY Master the Game Book Summary

In "Money: Master the Game," Tony Robbins unlocks the secrets to financial freedom through insights from legendary investors and his own transformative experiences. He presents a comprehensive blueprint that demystifies the world of finance, empowering readers to take control of their financial destinies. Packed with actionable strategies, Robbins reveals the psychological barriers that hold us back from wealth and how to overcome them. The book challenges conventional wisdom, urging readers to think differently about money and investing. Get ready to embark on an enlightening journey that could reshape your financial future forever!

The Little Book of Behavioral Investing Book Summary

**The Little Book of Behavioral Investing** uncovers the psychological traps that often lead investors astray. With a blend of insightful anecdotes and cutting-edge research, it reveals how emotions like fear and greed shape our decisions in the financial world. Readers will discover practical strategies to counteract these biases and improve their investment outcomes. By understanding the behavioral factors at play, you can transform your investment approach. Are you ready to challenge your thinking and elevate your financial game?

Liar's Poker Book Summary

Liar's Poker takes you deep into the high-stakes world of Wall Street during the 1980s, where the line between truth and deception blurs in the cutthroat arena of finance. Author Michael Lewis pulls back the curtain on the chaotic life of bond traders, showcasing a ruthless culture driven by greed and bravado. Through vivid anecdotes and sharp insights, readers are thrust into the thrilling, sometimes absurd realm of investment banking. As Lewis navigates the intricacies of "big swinging d***s," he unveils the strategies and psychological games that define success in this high-pressure environment. Will you emerge with a new understanding of the financial world and its enigmatic players?

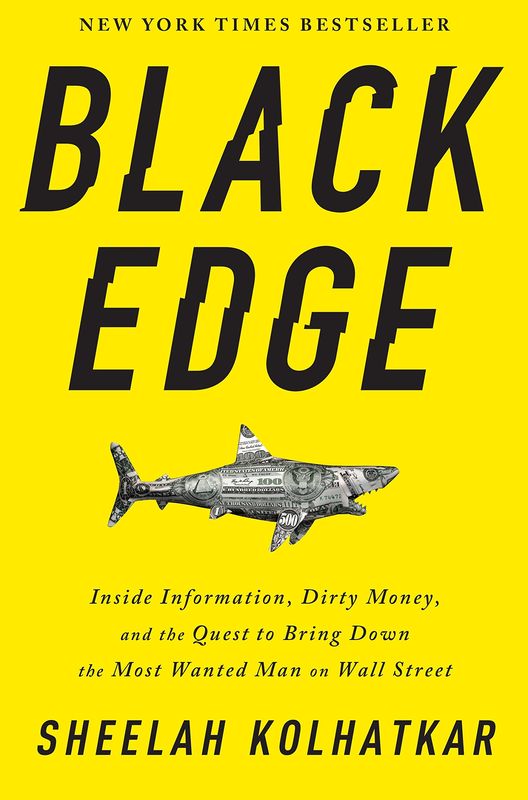

Black Edge Book Summary

In "Black Edge," investigative journalist Sheelah Kolhatkar delves into the high-stakes world of hedge funds and the enigmatic figure of Steven A. Cohen. As she unravels the saga of insider trading, greed, and Wall Street's murky ethics, the book pulls readers into a gripping tale of ambition that spans decades. With intellectual prowess and audacious risk-taking, Cohen's rise to power raises questions about the moral compass of finance. Kolhatkar's penetrating analysis unveils the dark side of wealth and the relentless pursuit of success, leaving readers questioning the true cost of ambition. Will you dare to uncover the secrets of a financial titan and the shadowy underworld they inhabit?

Poor Charlie’s Almanack Book Summary

Poor Charlie’s Almanack is an enlightening compilation of wisdom from Charlie Munger, the renowned vice chairman of Berkshire Hathaway and lifelong partner of Warren Buffett. This thought-provoking collection delves into Munger's unique principles of investing, decision-making, and life philosophy, rich with wit and insight. Through anecdotes, illustrations, and a treasure trove of mental models, readers are inspired to think critically and embrace diverse perspectives. Munger’s emphasis on lifelong learning and rational thought challenges conventional thinking and encourages harnessing multidisciplinary knowledge for personal and professional success. Unlock the secrets of Munger’s remarkable intellect and discover how they can transform your approach to wealth and wisdom.

The Little Book of Common Sense Investing Book Summary

In 'The Little Book of Common Sense Investing,' John C. Bogle lays out a compelling case for a simple, yet effective, investment strategy that anyone can apply. He champions the power of low-cost indexing, which allows average investors to outperform the majority of actively managed funds over time. Bogle stresses the importance of patience and discipline in the face of market volatility, urging readers to ignore the noise of financial markets. With clear insights and straightforward advice, this book is a treasure trove for both novice and seasoned investors alike. Discover how to make your money work harder for you with strategies rooted in common sense!

The Essays of Warren Buffett Book Summary

In "The Essays of Warren Buffett," the legendary investor distills decades of wisdom into a compelling collection of insights on investing, business, and life. Through a series of thought-provoking essays, Buffett shares his unique perspective on risk, value, and the importance of patience in the tumultuous world of finance. His distinctive voice combines humor with profound lessons, making complex concepts accessible to both novice investors and seasoned pros. As you delve into his reflections, you'll uncover the principles that have guided his success and how they can be applied to your own financial journey. Prepare to be inspired and challenged to rethink your approach to investing and wealth-building!

Showing 8 of 30 similar books

Similar Book Recommendations →

Niki Scevak's Book Recommendations

Niki Scevak is a distinguished entrepreneur and venture capitalist, widely recognized for his contributions to the startup ecosystem rather than traditional literature. As a co-founder and partner at Blackbird Ventures, he has played a pivotal role in funding and mentoring successful Australian tech startups. Scevak also co-founded Startmate, an influential accelerator program that has shaped numerous early-stage companies. His work has significantly impacted the Australian tech landscape, fostering innovation and entrepreneurial growth. Though not an author of traditional books, his insights and thought leadership are frequently shared through industry publications and speaking engagements.

Drew Houston's Book Recommendations

Drew Houston is an accomplished American entrepreneur best known for co-founding Dropbox, a widely-used cloud storage service, in 2007. As the CEO, he has led the company to serve millions of users worldwide and become a key player in the tech industry. Although not primarily known for literature, Houston has shared his entrepreneurial insights and experiences through various interviews and public speaking engagements, offering valuable lessons to aspiring business leaders. His work has significantly influenced the way people and organizations manage and share digital content. Houston's innovative vision continues to shape the future of cloud computing and digital collaboration.

James Clear's Book Recommendations

James Clear is the author of the bestselling book Atomic Habits, which focuses on the power of small habits and incremental improvements to achieve significant personal and professional growth. Clear’s writing blends insights from psychology, neuroscience, and productivity to provide practical strategies for building better habits. His work has helped millions of people create positive changes in their lives by focusing on the process rather than the outcome. James’s clear, actionable advice has made him a sought-after speaker and thought leader in the field of personal development.

Sophie Bakalar's Book Recommendations

Sophie Bakalar is a distinguished author and venture capitalist known for her adept storytelling and insightful exploration of contemporary issues. Her debut novel received critical acclaim for its nuanced portrayal of complex characters and societal dynamics. In addition to her literary achievements, Bakalar is a co-founder of a successful venture firm, where she leverages her keen understanding of market trends and innovation. Her essays and articles, often featured in prominent publications, reflect her deep engagement with cultural and technological shifts. Bakalar's multifaceted career bridges the worlds of literature and entrepreneurship, making her a unique voice in both fields.

Tony Robbins's Book Recommendations

Tony Robbins is a life coach, motivational speaker, and bestselling author known for his self-help books, including Awaken the Giant Within and Unlimited Power. He has worked with athletes, business leaders, and world figures to help them maximize their potential. Robbins is known for his dynamic seminars and workshops, where he teaches people strategies for achieving personal and professional success. His focus on emotional mastery, peak performance, and financial independence has made him a global leader in the self-improvement industry. Robbins has built a multi-million dollar business empire around his personal development programs.

Bill Ackman's Book Recommendations

Bill Ackman is an American hedge fund manager and founder of Pershing Square Capital Management, known for his activist investing style. Ackman has been involved in high-profile investment battles, including his campaigns against companies like Herbalife and his successful turnaround of companies like Canadian Pacific Railway. He is known for taking bold, contrarian positions and for his ability to influence corporate governance through shareholder activism. Ackman’s investing philosophy focuses on long-term value creation, and he has become one of the most recognized figures in the finance world.

Charlie Munger's Book Recommendations

Charlie Munger is an American investor, businessman, and philanthropist, best known as the vice chairman of Berkshire Hathaway, where he partners with Warren Buffett. Renowned for his insights on investment strategies and mental models, Munger has significantly influenced the world of finance. His notable literary contributions include "Poor Charlie's Almanack," a compilation of his speeches and writings that distill his wisdom on decision-making and business principles. Munger's work emphasizes the importance of multidisciplinary thinking and continuous learning. Beyond his financial acumen, he is celebrated for his charitable efforts, particularly in education and healthcare.

Andrew Lokenauth's Book Recommendations

Andrew Lokenauth is a distinguished author and financial expert known for his insightful contributions to personal finance and investment literature. With a career spanning over a decade, he has written extensively on topics such as wealth management, financial planning, and market analysis. Lokenauth's works are celebrated for their clarity and practical advice, making complex financial concepts accessible to a broad audience. He has been featured in numerous financial publications and has established himself as a trusted voice in the industry. Beyond his writing, Lokenauth is also a sought-after speaker, sharing his expertise at various seminars and workshops.

Showing 8 of 20 related collections

“The most important thing is not how much you know, but how well you can apply that knowledge in the real world.”

The Most Important Thing

By Howard Marks

Frequently Asked Questions

Explore Our Catalogue

Discover a world of knowledge through our extensive collection of book summaries.

Genres

Genres

Genres

Featured Collections

- Top Book Club Picks

- One-Stop Nutrition

- Summer Reads 2024

- Best Beach Reads 2024

- Work-Life Balance Guide

- Time Management

- Healthy Foods

- Entrepreneur Toolkit

- Mind & Body Wellness

- Future Tech Insights

- Leadership Essentials

- Financial Freedom

- Sci-Fi Masterpieces

- Parenting 101

- Books That Became Blockbusters

- Guide to a Healthy Pregnancy