In 'The Theory of Investment Value', John Burr Williams presents a groundbreaking framework for evaluating the intrinsic value of investments. He challenges conventional practices, offering a fresh perspective that emphasizes future cash flows over historical prices. This seminal work lays the foundation for modern financial analysis and investment strategies, pre-dating many contemporary valuation methods. With compelling arguments and mathematical rigor, Williams redefines how investors perceive value in the stock market. Dive into this influential text to uncover the principles that continue to shape investment decision-making today.

By John Burr Williams

Published: 1997

""Investment value is determined by the cash flows that an investment can generate over its economic life, not by the whims of the market or the noise of speculation.""

Written as a Ph. D. thesis at Harvard in 1937.-Publisher's website.

Showing 8 of 24 similar books

James Clear is the author of the bestselling book Atomic Habits, which focuses on the power of small habits and incremental improvements to achieve significant personal and professional growth. Clear’s writing blends insights from psychology, neuroscience, and productivity to provide practical strategies for building better habits. His work has helped millions of people create positive changes in their lives by focusing on the process rather than the outcome. James’s clear, actionable advice has made him a sought-after speaker and thought leader in the field of personal development.

David Cancel is a prominent entrepreneur and author best known for his influential work in the tech and startup communities. As the CEO and co-founder of Drift, a leading conversational marketing platform, he has revolutionized how businesses engage with their customers online. Cancel has also authored insightful books such as "Hypergrowth," which offers valuable strategies for scaling startups rapidly. His contributions extend beyond literature as he frequently shares his expertise through speaking engagements and his popular podcast, "Seeking Wisdom." David Cancel's innovative ideas and practical advice continue to inspire and guide entrepreneurs worldwide.

Bill Ackman is an American hedge fund manager and founder of Pershing Square Capital Management, known for his activist investing style. Ackman has been involved in high-profile investment battles, including his campaigns against companies like Herbalife and his successful turnaround of companies like Canadian Pacific Railway. He is known for taking bold, contrarian positions and for his ability to influence corporate governance through shareholder activism. Ackman’s investing philosophy focuses on long-term value creation, and he has become one of the most recognized figures in the finance world.

Charlie Munger is an American investor, businessman, and philanthropist, best known as the vice chairman of Berkshire Hathaway, where he partners with Warren Buffett. Renowned for his insights on investment strategies and mental models, Munger has significantly influenced the world of finance. His notable literary contributions include "Poor Charlie's Almanack," a compilation of his speeches and writings that distill his wisdom on decision-making and business principles. Munger's work emphasizes the importance of multidisciplinary thinking and continuous learning. Beyond his financial acumen, he is celebrated for his charitable efforts, particularly in education and healthcare.

Andrew Lokenauth is a distinguished author and financial expert known for his insightful contributions to personal finance and investment literature. With a career spanning over a decade, he has written extensively on topics such as wealth management, financial planning, and market analysis. Lokenauth's works are celebrated for their clarity and practical advice, making complex financial concepts accessible to a broad audience. He has been featured in numerous financial publications and has established himself as a trusted voice in the industry. Beyond his writing, Lokenauth is also a sought-after speaker, sharing his expertise at various seminars and workshops.

Howard Marks was a renowned Welsh author and drug smuggler, best known for his bestselling autobiography, "Mr Nice," published in 1996. The book chronicles his complex life, from Oxford University graduate to one of the world's most infamous cannabis traffickers. Marks' candid storytelling and unique perspective earned him a cult following and critical acclaim, transforming him into a counterculture icon. He further contributed to literature with several other works, including "Señor Nice" and "Sympathy for the Devil." Marks' legacy continues to influence discussions on drug policy and the criminal justice system.

Guy Spier is a renowned value investor and author, best known for his influential book "The Education of a Value Investor," which offers deep insights into the principles of value investing and personal development. An alumnus of Harvard Business School and Oxford University, Spier has carved a niche in the financial world with his disciplined investment philosophy. He is the managing partner of the Aquamarine Fund, an investment partnership inspired by the principles of Warren Buffett. Spier gained widespread recognition for his charitable winning bid to have lunch with Buffett, a move that significantly bolstered his reputation in the investment community. Through his writing and public speaking, Spier continues to inspire both novice and seasoned investors with his ethical approach to investing and life.

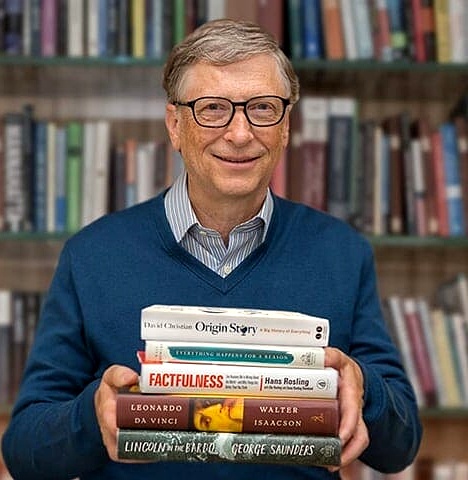

Bill Gates, co-founder of Microsoft Corporation, is a pioneering figure in the tech industry, having played a key role in the personal computer revolution. His work at Microsoft, particularly the development of Windows, transformed software and computing globally. Beyond his technology contributions, Gates is also a prolific author, with notable works such as "The Road Ahead" and "Business @ the Speed of Thought," which offer insights into the future of technology and business. Additionally, his philanthropic efforts through the Bill & Melinda Gates Foundation have had a profound impact on global health, education, and poverty. Gates continues to influence both technology and literature with his forward-thinking perspectives and innovative ideas.

Showing 8 of 10 related collections

“"Investment value is determined by the cash flows that an investment can generate over its economic life, not by the whims of the market or the noise of speculation."”

The Theory of Investment Value

By John Burr Williams

Discover a world of knowledge through our extensive collection of book summaries.

John Burr Williams was a distinguished American economist and author, renowned for his influential works in the field of finance and investment. His seminal book, 'The Theory of Investment Value' (1938), provided foundational insights into the valuation of securities and introduced concepts still relevant in modern finance. Williams is celebrated for his analytical approach and clarity of thought, combining rigorous mathematical analysis with practical insights that appeal to both academics and practitioners. His contributions laid the groundwork for contemporary investment theory and have left an enduring mark on the discipline.

Key information about the book.

Support local bookstores: BookShop gives a portion of each sale to independent bookshops!

No summary available

In "The Intelligent Investor," Benjamin Graham unveils timeless strategies for navigating the volatile world of investing with wisdom and discipline. He introduces the concept of value investing, teaching readers to distinguish between price and intrinsic value, all while emphasizing the importance of a defensive investment strategy. Graham’s insightful principles empower investors to cultivate emotional resilience, protecting them from the relentless whims of the market. With real-world anecdotes and practical advice, this classic remains a cornerstone for anyone seeking financial success and peace of mind. Dive in to discover how patience, rationality, and a solid plan can transform your investment journey!

In "The Money Class," Suze Orman redefines financial literacy in a world where traditional rules no longer apply. She reveals the secrets to navigating modern economic challenges, providing actionable advice on saving, investing, and building wealth. Orman emphasizes the importance of understanding your personal values and translating them into financial choices. With relatable stories and practical tips, she empowers readers to take control of their financial futures. Are you ready to transform your relationship with money and unlock the life you deserve?

In "The Latte Factor," personal finance expert David Bach unveils a transformative story that intertwines the journey of a young woman discovering the power of financial freedom. Through the lens of a seemingly simple daily ritual—her coffee habit—she learns profound lessons about saving and investing. With relatable characters and an engaging narrative, Bach challenges readers to rethink their spending habits and recognize the true cost of indulgences. Could a small shift in perspective lead to monumental changes in your financial future? Dive into this inspiring tale and unlock the secrets to achieving your dreams, one latte at a time!

In "Smart Money Smart Kids," financial expert Dave Ramsey teams up with his daughter Rachel Cruze to tackle the crucial lessons of money management for a new generation. Through relatable anecdotes and practical strategies, they empower parents to teach their children about earning, saving, and investing wisely. The book challenges traditional views on money, emphasizing the importance of character and values in financial decision-making. With engaging activities and clear guidelines, readers are equipped to foster a healthy relationship with money early on. Dive in to discover how to raise financially savvy kids who are prepared for life’s economic challenges!

**The Little Book of Behavioral Investing** uncovers the psychological traps that often lead investors astray. With a blend of insightful anecdotes and cutting-edge research, it reveals how emotions like fear and greed shape our decisions in the financial world. Readers will discover practical strategies to counteract these biases and improve their investment outcomes. By understanding the behavioral factors at play, you can transform your investment approach. Are you ready to challenge your thinking and elevate your financial game?

In 'I Will Teach You to Be Rich, Second Edition,' Ramit Sethi provides a no-nonsense guide to mastering personal finance with a blend of humor and practicality. He challenges conventional money advice and introduces readers to a unique banking system for maximizing their savings. Through straightforward strategies, Sethi reveals how to automate finances and invest wisely for the long term. Each chapter brims with actionable tips that encourage readers to take control of their financial futures. With insights that delve deep into psychology and behavior, this book is a game-changer for anyone seeking to build real wealth.

In "The Millionaire Fastlane," MJ DeMarco challenges conventional wisdom about wealth and success, unveiling a provocative path to financial freedom. He argues that the traditional mindset of saving and investing is a slow lane to mediocrity, while the "Fastlane" offers a dynamic blueprint for entrepreneurship. Through compelling anecdotes and insightful strategies, DeMarco illustrates how creating value and leveraging your time can accelerate your journey to millionaire status. As he breaks down the myths surrounding money, readers are propelled to rethink their own financial strategies. Are you ready to abandon the rearview mirror of the slow lane and embrace the thrill of the Fastlane?